More and more investors are showing interest in investing in foreign real estate. Investors can save costs and optimize their investment capital for profit by taking advantage of the benefits offered by different countries. Vietnam’s potential as a market for industrial real estate has caught the attention of investors, who are eagerly vying for a piece of this profitable opportunity.

Rapid economic development, population growth, urbanization, public investment, and infrastructure, along with an increase in foreign investment, have created a promising environment for the real estate sector in the region. Asia region.

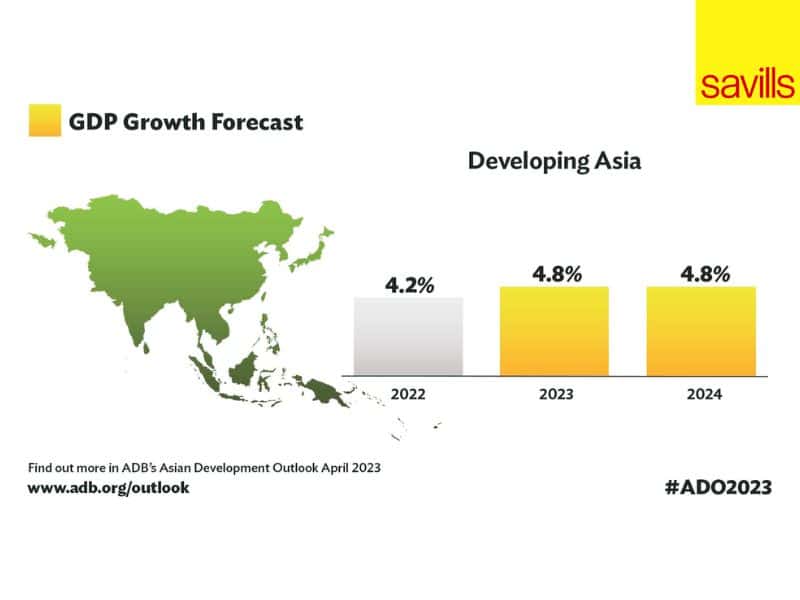

The GDP of Asian countries is forecast to grow by 4.8% in 2023

According to ADB’s Asian Development Outlook, the Asia-Pacific region will grow 4.8% in 2023 and 2024, higher than the 4.2% growth rate in 2022. The region’s remarkable increase in economic growth presents a golden opportunity for real estate investors to capitalize on favorable circumstances.

The trend of investing in foreign real estate in Asia is also increasing. According to data from the National Bureau of Statistics of China, in 2022, foreign direct investment (FDI) in real estate in China increased by 5.7% year-on-year, reaching $235 billion. Global investors with a keen interest in the Asian real estate market can take heart from this encouraging news, which reinforces their trust in this lucrative sector.

In Asia, along with potential markets such as India, Singapore, Thailand, Indonesia, etc., Vietnam is also one of the best foreign real estate markets, a “fat pie” for investors to keep an eye on in the near future.

Keeping a safe geopolitical position, and attracting world powers such as the US, China, and Russia, the Vietnamese market always receives “favors” for economic development and international cooperation.

Vietnam’s economy is forecasted to grow strongly in 2023, attracting strong FDI capital

A series of Trade Agreements that have been and are about to be signed will be opened to accelerate the process of economic recovery and development. Owning foreign real estate is the basis for bringing competitive advantages to global supply chains.

According to statistical data, in the first 5 months of 2023, Vietnam attracted nearly 10.68 billion USD in FDI, up 10.6% compared to the first 4 months and 92.7% over the same period last year. In the real estate sector, total FDI capital reached 10.86 billion USD, down 7.3% over the same period last year.

In order to attract investors to buy foreign real estate in Vietnam, the Government has loosened the credit room, reduced interest rates, and provided tax incentives to create favorable conditions for businesses.

The difference between Vietnam and other markets is the diversification of industrial real estate types. Many production projects were built, industrial land banks expanded, and logistics and cold storage services are also emerging strongly thanks to the breakthrough of the retail industry.

With all these factors, Vietnam is the best foreign real estate investment in the Asia-Pacific region.

The potential of Vietnam has made many foreign real estate investors look for high-profit projects to invest in. Savills Vietnam is a leading partner in consulting with many businesses on how to buy foreign real estate in Vietnam.

With the rapid development of industry and e-commerce, investors are looking for investment opportunities in industrial parks, export processing zones, and warehouses.

Savills Vietnam – A prestigious address for foreign investors in Vietnam’s real estate market

With a continuously updated data system, anticipating investment trends and market transformation, Savills Vietnam provides detailed information on potential projects in this field, as well as advice on strategies for investment projects. investment strategy, profitability, and project management.

Savills Vietnam’s industrial and logistics real estate projects are built to high standards and fully meet the requirements of modern industry. These areas are designed with available infrastructure, convenient transportation, and close proximity to important seaports, creating favorable conditions for logistics and freight activities.

With a skilled team of professionals and a comprehensive understanding of the industrial and logistics real estate market, we strive to help our clients achieve success and profitability in their projects.

Here are our impressive collection of exceptional projects and initiatives:

– The whole area: 43,092m2

– Vacant area: 31,824m2

– Lot size: 500 – 2,200m2

– Ground floor capacity: 1.5 tons/m2

– Rent cost: Contact Savills Vietnam

SBN-F36 High- High-rise factory for lease in Bac Ninh

– The whole area: 46,747m2

– Vacant area: 22.080m2

– Rent cost: Contact Savills Vietnam

SDN – FFL07 – Factory for lease in Dong Nai

– The whole area: 1,556ha

– Vacant area: 1,556ha

– Lot size: from 15.00m2

– Rent cost: Contact Savills Vietnam

SVT-LFL03 – Industrial land for lease in Ba Ria – Vung Tau

– The whole area: 21,634.34m2ha

– Vacant area: 17,750m2

– Load capacity: 2.3 tons/m2

– Rent cost: Contact Savills Vietnam

SLA – FFS08 Factory for transferred in Long An

Vietnam is predicted to be a “gold mine” for real estate investors when outside of political turmoil in the world. foreign countries in the process of forming the competitiveness of the global supply chain.

For real estate investment advice in the Vietnamese market, please contact Mr John Campbell via hotline: 0986.718.337 or senior staffs of Savills Vietnam for advice and reasonable investment orientation.

In addition, you can refer to potential industrial real estate projects of Savills Industrial here.