With its post-pandemic economic development and the growth of its industrial sector, Vietnam has emerged as a promising investment destination for businesses looking to expand in Southeast Asia or Asia as a whole. The country offers numerous opportunities for investment in its industrial sector, including relocation from China, access to Southeast Asian markets, and leveraging highly attractive free trade agreements.

However, like any investment destination, Vietnam also presents challenges such as political and regulatory risks, legal and operational challenges, cultural and language barriers, currency and financial risks, and intellectual property protection issues.

In this article, we will delve into the various aspects of investing in Vietnam’s industrial sector, including the benefits, challenges, and tips for successful investment, as well as how to get started with investing in Vietnam.

Vietnam’s market becomes a potential destination for foreign investors

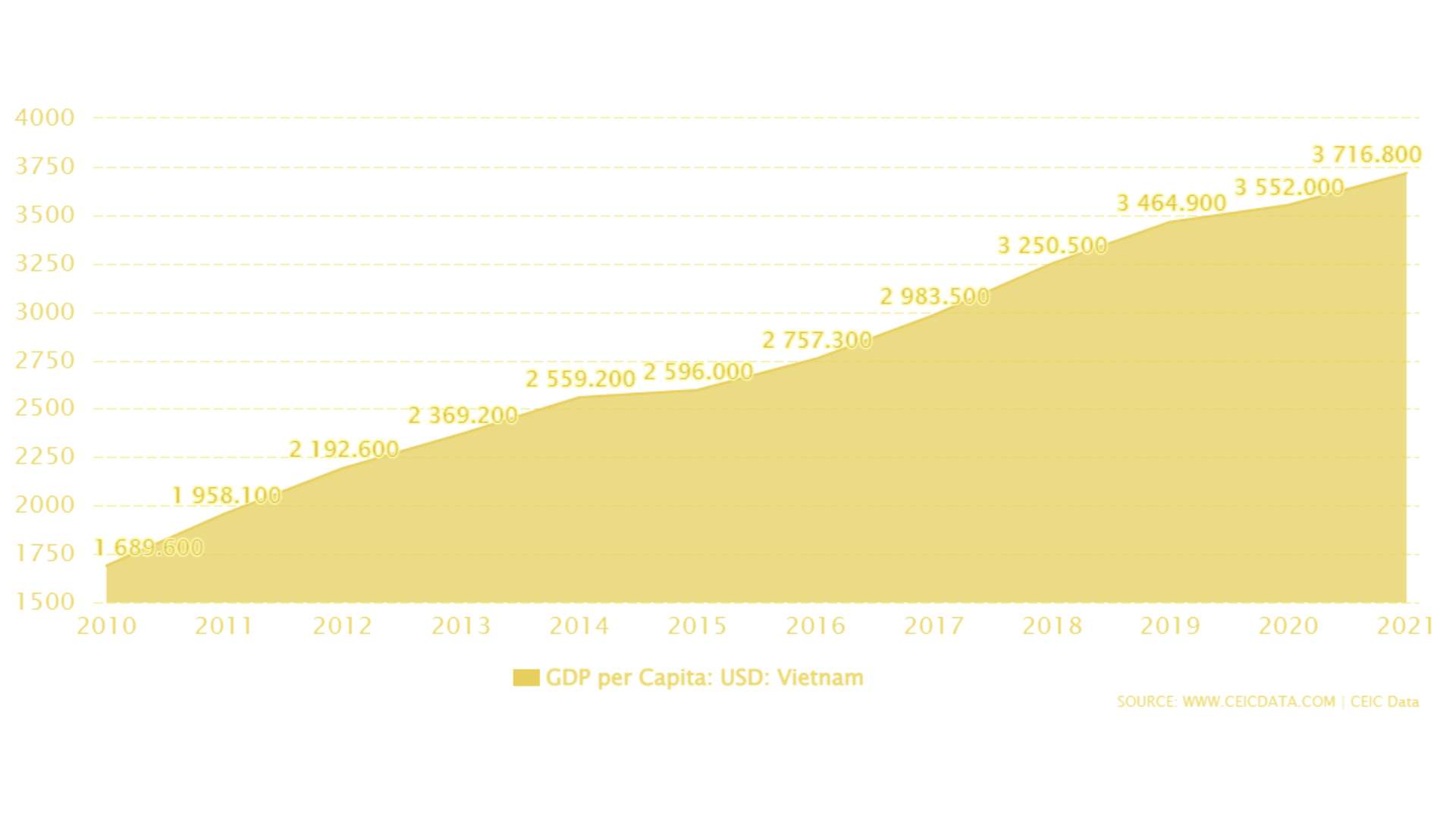

Vietnam’s industrial sector has been a key driver of its economic growth, contributing significantly to its GDP and exports. The industrial sector has undergone rapid development in recent years, with a focus on high-tech industries, electronics, and manufacturing. The government has also taken steps to attract foreign investment and support the growth of domestic businesses in the industrial sector.

Implementing the right and attractive policy of attracting foreign investment into Vietnam, as of November 2022, the total amount of FDI capital was more than 25.1 billion USD, equal to 95% compared to the same period in 2021. There are 1,812 new projects with a total capital of more than 11.5 billion USD.The number of projects with adjusted investment capital is 994, with the total additional capital reaching nearly $9.54 billion. This shows the strong attraction and confidence of Vietnam in foreign enterprises to expand investment in existing projects.

Up until now, there have been 107 countries and territories investing in Vietnam. Singapore has invested the most in Vietnam, with 5.78 billion USD, accounting for 23%; Japan has invested more than 4.6 billion USD, accounting for 18.3%; and South Korea has invested 4.1 billion USD, accounting for 16.4%.

The manufacturing industry group ranks first in attracting FDI; real estate businesses rank second among foreign projects to invest in Vietnam, with more than 3.87 billion USD accounting for 17.2% of total capital.

With favorable conditions, finding FDI capital for industrial real estate projects is extremely easy. However, for this process to take place smoothly and to harmonize the interests of the parties, it is necessary to support professional consulting units to connect with and understand market trends.

There are several opportunities for foreign investors in Vietnam’s industrial sector, which makes it an attractive investment destination.

The ongoing trade tensions between the US and China, coupled with rising labor costs and other challenges, have prompted many companies to explore alternative manufacturing locations, with Vietnam being a top choice for relocation. This trend has significant implications for Vietnam’s industrial industry, as the country is increasingly viewed as an attractive destination for foreign investment and a potential alternative to China as a manufacturing hub.

Vietnam’s strategic location, abundant natural resources, and growing skilled workforce make it an attractive destination for companies looking to relocate from China. In recent years, Vietnam has also taken steps to improve its business environment, reduce bureaucracy, and attract foreign investment, all of which have contributed to the growth of its industrial sector.

The shift of manufacturing from China to Vietnam has led to an increase in demand for industrial properties, such as factories and warehouses. This has presented opportunities for property developers and foreign investors in the industrial real estate market in Vietnam. The demand for industrial properties is expected to continue growing, especially in key industrial hubs such as Ho Chi Minh City, Hanoi, and the surrounding provinces.

Overall, the relocation from China to Vietnam is expected to bring significant benefits to Vietnam’s industrial industry, including increased investment, job opportunities, and technology transfer. With the right policies and strategies in place, Vietnam’s industrial sector is poised to continue on a positive growth trajectory and play a key role in the country’s overall economic development.

Investing in Vietnam offers several benefits, including access to Southeast Asian markets. Some of the key benefits are:

– Large emerging market potential: Vietnam’s population of nearly 100 million people offers a significant consumer market with a growing middle class and increasing disposable income.

– Strategic location: Vietnam’s location in the heart of Southeast Asia provides easy access to regional markets, including Cambodia, Laos, Myanmar, Thailand, and Indonesia.

– Free trade agreements: Vietnam has signed several free trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA), which provide preferential access to a combined market of over 500 million people.

– Favorable business environment: Vietnam has taken steps to improve its business environment, including reducing bureaucracy, streamlining administrative procedures, and offering tax incentives for investors.

– Growing infrastructure: Vietnam is investing heavily in infrastructure, with major projects in transportation, energy, and telecommunications. This provides a solid foundation for businesses looking to expand operations and access new markets.

Investing in Vietnam means taking advantage of the highly attractive free trade agreements (FTAs) that the country has signed with several countries and blocs. Here are some key FTAs that foreign investors can leverage when investing in Vietnam:

– Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): This FTA includes 11 countries, such as Japan, Canada, Australia, and New Zealand. It reduces tariffs on a wide range of goods and services, promotes investment and economic integration, and establishes modern rules for trade.

– EU-Vietnam Free Trade Agreement (EVFTA): This FTA eliminates over 99% of tariffs on goods traded between the European Union (EU) and Vietnam, making it easier and cheaper for businesses to trade between the two regions. It also includes provisions on intellectual property, labor rights, and environmental protection.

– Regional Comprehensive Economic Partnership (RCEP): This FTA includes 15 countries in the Asia-Pacific region, including China, Japan, South Korea, and Australia. It covers trade in goods and services, investment, intellectual property, and e-commerce.

– ASEAN Free Trade Area (AFTA): This FTA is a regional initiative among the ten ASEAN member countries to reduce tariffs on goods traded within the region. It aims to promote intra-regional trade and investment, enhance competitiveness, and integrate ASEAN into the global economy.

By leveraging these FTAs, investors in Vietnam can access a larger market, reduce costs, and increase competitiveness. Vietnam’s strategic location, favorable business environment, and growing infrastructure also make it an attractive investment destination in the region.

Read more: What’s the Smartest Way to Invest in Vietnam’s Industrial Property for Sale?

Despite the business opportunities in Vietnam, investing in the country’s industrial sector also presents challenges that businesses need to be aware of and navigate carefully. Some of the key challenges include:

When considering investing in Vietnam’s industrial sector, it’s important to be aware of the potential political and regulatory risks that may pose a challenge. While Vietnam has made significant progress in creating a more business-friendly environment, there are still some risks to consider.

One such risk is the possibility of changes to government policies and regulations. Vietnam’s government is known to frequently change policies and regulations, which can be difficult for businesses to keep up with. This can create uncertainty and affect business operations and profitability.

Another risk is corruption, which is still a problem in Vietnam. While the government has taken steps to address corruption, it remains a concern for businesses operating in the country.

Finally, there is the risk of labor disputes and strikes, which can disrupt operations and impact profitability. It’s important for businesses to have effective labor relations policies in place and to ensure they are in compliance with local labor laws.

The legal system in Vietnam is still developing, and businesses may face legal challenges related to contracts, intellectual property, labor, and other areas. The enforcement of contracts and protection of intellectual property rights can be challenging at times, and investors need to carefully navigate the legal landscape and seek professional legal advice when investing in Vietnam’s industrial sector. Additionally, operational challenges such as logistics, infrastructure, and supply chain management may also pose challenges for businesses.

Vietnam has a unique culture and language, which may pose challenges for foreign investors. Language barriers can hinder effective communication and business operations, and cultural differences may impact business relationships and negotiations. It is essential for investors to understand and respect the local culture, build relationships with local stakeholders, and have effective communication strategies in place.

Vietnam’s currency, the Vietnamese dong (VND), is not fully convertible, and there may be restrictions on the repatriation of profits and capital. Exchange rate fluctuations can also pose risks to businesses, especially those engaged in import and export activities. Investors need to carefully manage currency and financial risks, including hedging strategies, to mitigate potential losses and ensure smooth repatriation of profits.

Intellectual property protection can be a challenge in Vietnam, with issues such as trademark infringement, copyright violations, and counterfeiting being prevalent. Investors need to take appropriate measures to protect their intellectual property rights, including registering trademarks and copyrights, implementing robust intellectual property protection strategies, and working with legal experts to enforce their rights.

Investing in Vietnam’s industrial sector can be a promising opportunity for foreign investors, but it also comes with its own set of challenges. To make the most of this opportunity, here are some tips to keep in mind:

Before investing in Vietnam’s industrial sector, it is crucial to conduct thorough market research to understand the emerging market dynamics, industry trends, customer preferences, and competition. This includes studying the regulatory environment, understanding the cultural nuances, and assessing the demand-supply dynamics in the sector. Market research helps businesses make informed investment decisions and develop effective market entry strategies.

Here are some key points to keep in mind:

– Understand the local market: It’s important to understand the local market and its unique characteristics, including customer preferences, demand trends, and local competition. This can help you identify market gaps and opportunities.

– Research the regulatory environment: Vietnam’s legal and regulatory environment is constantly evolving. Staying up-to-date with regulatory changes and requirements is crucial to avoiding potential compliance issues.

– Assess economic and political risks: Vietnam is a developing country with a relatively high level of political and economic risk. It’s important to understand these risks and take steps to mitigate them, such as diversifying your investments and building strong relationships with local partners.

When it comes to investing in Vietnam’s industrial sector, building relationships with local stakeholders is an important factor for success. These stakeholders can include government officials, suppliers, customers, and other businesses in the industry.

Here are some tips for building relationships with local stakeholders:

– Understand the culture: Vietnamese culture places a high value on personal relationships and trust. It’s important to take the time to build rapport with local stakeholders and establish trust before discussing business matters.

– Attend industry events: Attending industry events, such as trade shows or conferences, is a great way to meet local stakeholders and learn more about the industry.

– Network: Building a strong professional network is essential for success in Vietnam. Utilize online networking tools and attend local business events to meet new contacts.

– Offer value: When approaching local stakeholders, be sure to offer something of value. This can include expertise, resources, or access to new markets.

– Be patient: Building relationships takes time, and it’s important to be patient and persistent in your efforts to establish connections with local stakeholders.

By building strong relationships with local stakeholders, investors can gain a better understanding of the local market and navigate the unique challenges and opportunities of investing in Vietnam’s industrial sector.

Navigating the business landscape in Vietnam can be complex, and it is advisable to partner with local experts or consultants who have a deep understanding of the local market, regulations, and business practices. Here are some reasons for you to consider:

– Local market knowledge: Local experts or consultants can provide valuable insights into the local market, including information on the industrial sector’s trends, customer needs, and potential challenges.

– Regulatory compliance: Local experts or consultants can help navigate the complex regulatory environment in Vietnam and ensure compliance with local laws and regulations.

– Access to local networks: Local experts or consultants often have established relationships with key players in the industry, such as suppliers, distributors, and government officials, which can be beneficial for building business connections and identifying new opportunities.

– Cultural understanding: Cultural differences can impact business practices and communication in Vietnam. Local experts or consultants can bridge the gap by providing guidance on cultural norms and practices that may impact business decisions.

Partnering with local experts or consultants can provide foreign investors with a competitive advantage in navigating the unique challenges of investing in Vietnam’s industrial sector.

Vietnam has specific legal and regulatory requirements for foreign investors, and it is essential to understand and comply with these requirements. This includes obtaining the necessary permits and licenses, understanding labor laws, tax regulations, and environmental regulations, and adhering to corporate governance standards. Businesses should work with legal experts to ensure compliance with local laws and regulations.

Investing in any industry comes with a certain level of risk, and investing in Vietnam’s industrial sector is no exception. However, these risks can be managed through proper due diligence and risk mitigation strategies. In this section, we will discuss some tips for managing risks when investing in Vietnam’s industrial sector.

– Conduct thorough due diligence: Before investing in any industrial property, it is important to conduct thorough due diligence. This includes researching the property, the seller, and the local market. You should also consider hiring a local lawyer to review all legal documents and contracts.

– Understand the local regulations: Vietnam has its own set of regulations governing the industrial sector, and these can be complex and ever-changing. It is important to work with a local expert who understands the regulations and can help ensure compliance.

– Consider political and economic risks: Vietnam is a developing country and has a complex political and economic landscape. This includes the potential for corruption, currency fluctuations, and changes in government policies. It is important to understand these risks and have a plan in place to mitigate them.

– Diversify your investment portfolio: One of the best ways to manage risks is to diversify your investment portfolio. This means investing in multiple properties across different sectors and locations.

– Have a contingency plan: Finally, it is important to have a contingency plan in place in case something goes wrong. This could include having insurance to cover unexpected expenses or having a plan for exiting the investment if necessary.

By following these tips and working with a trusted partner like Savills Industrial, you can effectively manage risks and maximize your returns when investing in Vietnam’s industrial sector.

Starting an investment in Vietnam’s industrial sector requires careful planning and execution. Here are the general steps to start investing in Vietnam’s industrial sector:

– Define Investment Objectives: Clearly define the investment objectives, including the industry sector, investment size, expected returns, and investment horizon.

– Conduct Market Research: Conduct thorough market research to understand the emerging market dynamics, industry trends, customer preferences, and competition in Vietnam’s industrial sector.

– Develop a Business Plan: Develop a comprehensive business plan, including the investment strategy, market entry strategy, financial projections, risk assessment, and contingency plans.

– Seek Local Expertise: Partner with local experts or consultants who have a deep understanding of the local market, regulations, and business practices. They can provide valuable insights and help with regulatory compliance.

– Incorporate a Legal Entity: Establish a legal entity in Vietnam, which can be a joint venture, wholly foreign-owned enterprise (WFOE), or another legal form, depending on the investment structure and business objectives.

– Obtain Necessary Permits and Licenses: Obtain the necessary permits and licenses as per the local regulations and comply with all legal requirements governing foreign investment in Vietnam’s industrial sector. This may include licenses for land use, environmental permits, business licenses, and other relevant permits.

– Set Up Operational Infrastructure: Set up the necessary operational infrastructure, including manufacturing facilities, logistics, supply chain management, and workforce recruitment and training. This may involve identifying suitable locations for industrial parks or manufacturing facilities, establishing relationships with local suppliers, and recruiting and training local employees.

– Implement Risk Management Strategies: Implement risk management strategies to mitigate potential risks associated with investing in Vietnam’s industrial sector. This may include strategies such as currency hedging, insurance coverage, legal and operational risk assessments, and contingency plans.

– Establish Relationships with Local Stakeholders: Build relationships with local stakeholders, including government officials, local businesses, suppliers, customers, and communities. This can help businesses gain local support, access business opportunities, and navigate potential challenges.

– Monitor and Adapt: Continuously monitor and adapt the investment strategy based on market dynamics, regulatory changes, and other relevant factors. Regularly review the business plan, financial projections, risk assessments, and contingency plans to ensure the investment remains aligned with the objectives.

Savills Vietnam was established in 2017, providing full-service consulting services including real estate, manufacturing industry, and logistics provided by leading experts with extensive market knowledge and experience.

Possessing a huge volume of data analyzed by MS Power BI, Savills Vietnam provides detailed market assessments based on industry variables to help investors make choices. in line with industry trends.

Savills Vietnam, specializing in advising businesses to invest in Vietnam effectively, is catching up with market trends

Savills Vietnam experts will assist foreign investors investing in Vietnam in the field of industrial real estate in: entering the market, diversifying investment portfolios, expanding current operations, Develop a strategy for real estate leasing and the liquidation or acquisition of premises.

– Location: Binh Xuyen, Vinh Phuc

– Total area: 295 ha

– Vacant area: Contact us for details

– Land use time: 2071

– Contact Savills Vietnam for pricing

Green Park Vinh Phuc Industrial Park

– The whole area: 21,749m2

– Land use term: 2056

– Load capacity: 2 tons/m2

– Ceiling Height: 7–10 m

– Contact Savills Vietnam for pricing.

Factory transferred in Ben Cat, Binh Duong

– The whole area is 8.3 ha.

– Vacant area: 8.3 ha

– Land use term: 2053

– Contact Savills Vietnam for pricing.

Selling 8.3 hectares of industrial land in Long Thanh, Dong Nai

– The whole area: 342 ha

– Vacant area: 287 ha

– Land use term: 2061

– Contact Savills Vietnam for pricing.

Industrial land for rent in Ho Chi Minh City

Read more: How much is the rental price of industrial land during the lease period?

Due to the nation’s strong economic growth, favorable investment policies, abundance of natural resources, and advantageous location, Vietnam’s industrial sector offers significant opportunities for investors post-pandemic. With the government’s efforts to attract foreign investment and improve the business environment, investing in Vietnam’s industrial sector can be rewarding, but it also comes with its share of challenges.

Investors need to carefully assess the risks associated with investing in Vietnam’s industrial sector, including political and regulatory risks, legal and operational challenges, cultural and language barriers, currency and financial risks, and intellectual property protection issues. However, with thorough market research, local expertise, proper risk management strategies, and compliance with local laws and regulations, businesses can mitigate these risks and capitalize on the opportunities that Vietnam’s industrial sector has to offer.

As investors venture into Vietnam’s industrial sector, it is essential to keep in mind the tips mentioned, such as conducting thorough market research, partnering with local experts or consultants, building relationships with local stakeholders, navigating legal and regulatory requirements, and managing risks through proper due diligence and risk mitigation strategies. With careful planning and execution, investing in Vietnam’s industrial sector can yield positive results for businesses seeking growth opportunities in Southeast Asia with Savills Industrial. Contact us today!