The industrial real estate market in Viet Nam is experiencing robust growth, underpinned by the stability of the VND-USD exchange rate, which remains steady compared to other countries in the region. Moreover, the corporate income tax (CIT) incentives provide Viet Nam with a competitive edge over its regional counterparts like Malaysia and Indonesia.

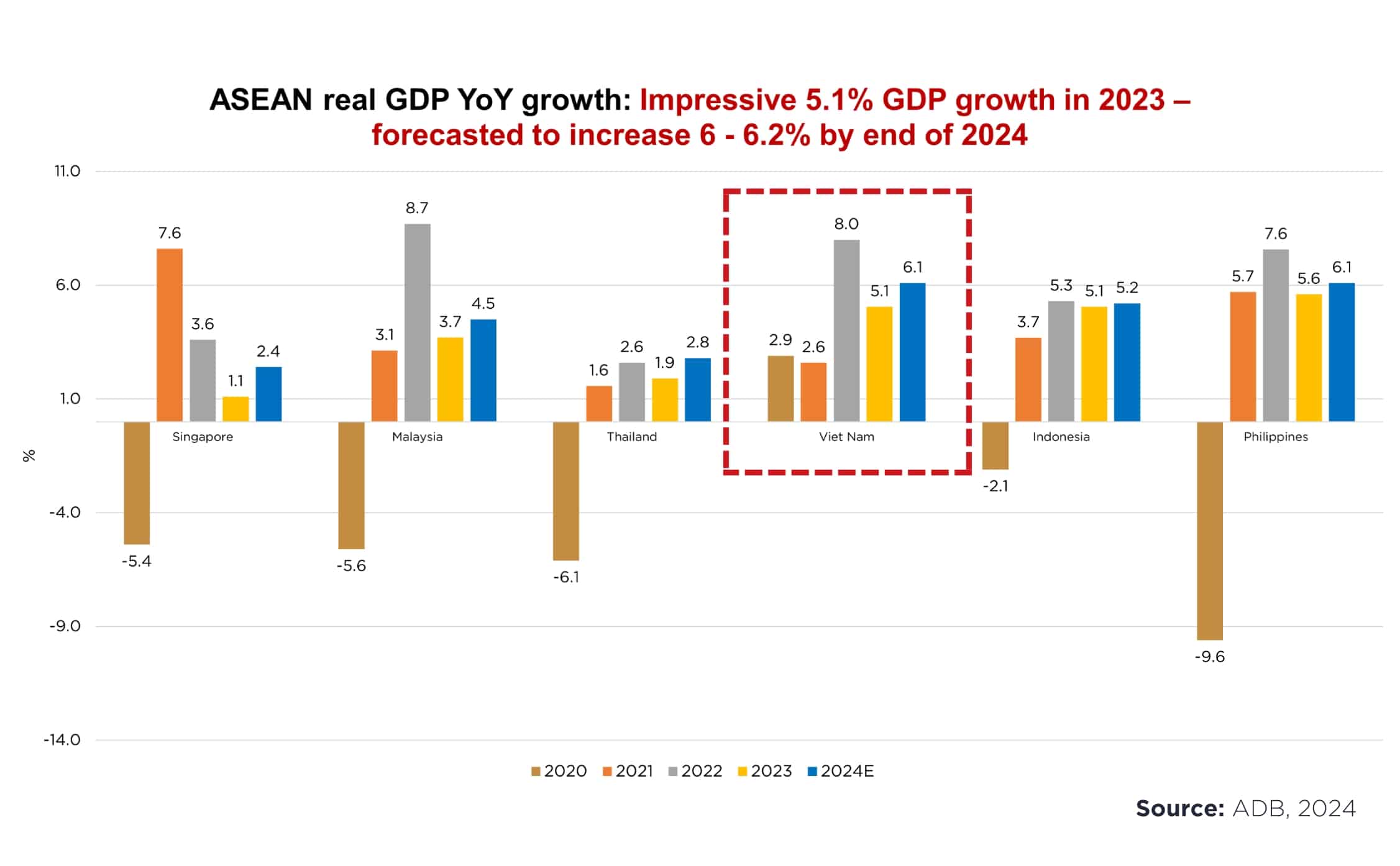

The Vietnamese government continues introducing new CIT incentive policies to maintain this advantage. According to the General Statistics Office, Viet Nam recorded impressive GDP growth of approximately 5.1% in 2023, higher than the growth rates of 2.87% and 2.55% in 2020 and 2021, respectively. This makes it the second highest in the region, on par with Indonesia and only behind the Philippines.

Figure 1: ASEAN real GDP YoY growth

According to Asian Development Bank’s 2024 statistic, Viet Nam’s workforce, with an average age of just over 32, holds significant potential for future development. The country’s focus on high value-added manufacturing investments and its competitive manufacturing salaries makes it an attractive destination for foreign investors, especially those seeking low production costs to maximize profits.

However, Viet Nam has strategically shifted its focus from lower value add industries to attracting high value-added manufacturing investments. This shift, which has cemented Vietnam’s reputation as one of the strongest emerging markets in the Asia Pacific, offers potential for high returns on investment. Viet Nam consistently demonstrates its global competitiveness by transitioning from an agriculture-based economy to an export-oriented one, particularly in the electronics and processing sectors.

Free trade agreements (FTAs) are crucial in attracting FDI to Viet Nam. Since joining the World Trade Organisation (WTO) in 1995, Viet Nam has signed and implemented a series of trade agreements, among which the Viet Nam-EU Free Trade Agreement (EVFTA) in 2019 has spurred a boom in foreign investment.

According to the Ministry of Planning and Investment, registered foreign direct investment (FDI) in Viet Nam in recent years shows that manufacturing and processing account for over 70% of total registered FDI, reflecting investors’ preference for this sector.

Mr Thomas Rooney, Senior Manager of the Industrial Real Estate Department at Savills Ha Noi, commented: “The concentration of FDI in manufacturing and processing not only brings direct economic benefits but also creates spillover effects, boosting the development of supporting industries and related services.”

Major technology corporations such as Samsung, LG, Intel, and Foxconn have significantly made Viet Nam a regional electronics manufacturing hub. Foxconn’s total investment in Viet Nam has recently reached USD 1.5 billion, with the new factory project in Bac Giang dedicated to assembling and processing phone components. This also reflects the trend of investing in high-value-added sectors in Northern Viet Nam.

Figure 2: Mr. Thomas Rooney, Senior Manager, Industrial Real Estate Department, Savills Ha Noi at Gateway to Growth 2024: Ha Noi and Northern Viet Nam Investment Landscape

Viet Nam’s geographical location is advantageous for manufacturing development.

Mr Thomas analysed, “Viet Nam’s geographical position, in the heart of the Asia-Pacific region, makes it an ideal destination for import-export activities. The manufacturing shift from China to Viet Nam is also significantly increasing, with Chinese companies and long-established U.S. and European firms in China looking to diversify or completely withdraw from China.”

In the Northern region, key provinces such as Bac Ninh, Hai Phong, and Thai Nguyen are becoming top destinations for FDI projects in the manufacturing sector. With its proximity to Ha Noi and developed infrastructure, Bac Ninh has attracted many large-scale projects from multinational corporations.

In the South, Binh Duong is also emerging as an important industrial hub, with many FDI enterprises in the manufacturing and processing sectors participating. However, the North still outperforms in the number and scale of new projects due to cost advantages and better transportation infrastructure.

Industrial land prices in the North are a significant advantage, with an average of approximately USD 138/m², 20% lower than in the South. In detail, in the South, strategic locations in prime areas like Binh Duong or Ho Chi Minh City can reach up to USD 300/m². Meanwhile, in the Northern market, the average price is only USD 180/m² for prime areas like Bac Ninh.

Figure 3: Ms Pham Thi Thu Trang, Business Development Manager of Industrial Real Estate at Core 5 – Indochina Kajima, at Gateway to Growth 2024: Ha Noi and Northern Viet Nam Investment Landscape

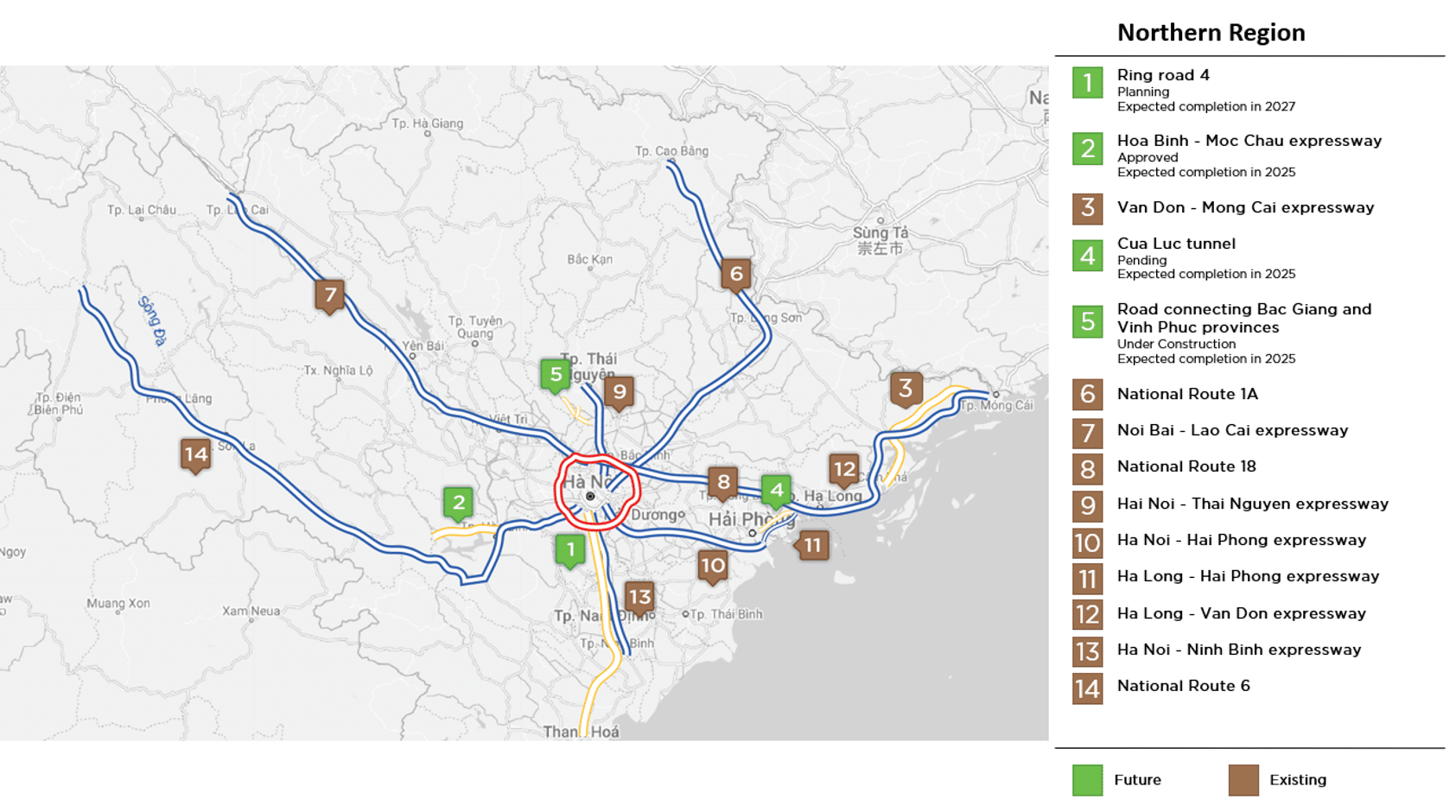

Infrastructure in the North is considered highly developed, with 10 completed expressways and 4 other projects underway. Whereas the South has only about 7 expressways.

Ms Pham Thi Thu Trang, Business Development Manager of Industrial Real Estate at Core 5 – Indochina Kajima, shared at the recent event “Gateway to Growth 2024: Ha Noi and Northern Viet Nam Investment Landscape”: “In Viet Nam, road transport is still the main mode of transportation, so easy access from production areas to consumption markets helps businesses optimise logistics costs. In particular, the expressways connecting industrial zones with Ha Noi and the Chinese border further enhance the North’s appeal to foreign investors.”

According to the government’s planning, the North has more economic zones than the South, notably the new coastal economic zone in Hai Phong, which covers over 20,000 hectares. The North also attracts investment thanks to its competitive labour market, as the average salary in the South is currently the highest in the country, recording VND 9.3 million.

Figure 4: Interprovincial highway system in the North

Although Viet Nam’s industrial real estate market holds great potential, one of the main challenges remains the shortage of skilled labour. This is particularly crucial as Viet Nam aims to enhance value-added production in its manufacturing sectors. Despite the abundant workforce, especially in the North, a large portion still consists of low-skilled workers. To address this issue, reforming education and training to improve labour skills is necessary.

Infrastructure development is also a key factor in enhancing Viet Nam’s competitiveness. Currently, infrastructure projects are primarily concentrated in certain areas, but expansion and synchronised development need to be nationwide. In particular, improving the transportation network connecting industrial zones with consumer markets will help optimise logistics costs, creating favourable business conditions. Strong infrastructure will support the movement and transportation of goods and strengthen Viet Nam’s ability to attract foreign investment.