Industrial warehouse space for lease in Southeast Asia has expanded dramatically in the last year. With eCommerce and logistics needing to work together to suit the growing expectations of customers, they are expanding their footprints across the country. Southeast Asia’s investment net worth has more than quadrupled in the last year, with international commerce and infrastructure development also playing important roles.

Industrial warehouse space for lease in Southeast Asia

Overview of Industrial Warehouse Space for Lease in Southeast Asia

Southeast Asia’s expanding digital economy has placed the area up for significant development. According to Asian Robotics Review statistics, it has a $2.5 trillion USD GDP economy that is increasing at a 6% annual rate, a literate population of over 600 million, a smartphone penetration of 35%, and more creative information sectors. Obviously, the ASEAN digital ecosystem has created a viable environment to support the development of industrial warehouse space for lease in Southeast Asia and delivery sectors.

The future of industrial warehouses for rent in Southeast Asia is optimistic as its market is expected to exceed $55 billion USD. However, it is critical that the sector optimizes and prepares for the issues that are weighing down their operations, even as they grow to support a thriving eCommerce economy.

The industry’s future is optimistic, as its market is expected to exceed $55 billion USD. However, it is critical that the sector optimizes and plans for the issues that are weighing down their operations, even as they grow to support a thriving eCommerce economy.

Singapore is clearly far ahead in logistics, especially in the industrial warehouse space for lease in Southeast Asia due to its facilities. Manufacturing there is still prohibitively costly, but it is particularly appealing as a storage facility and cross-dock location since its trade regulations are favorable and it has the necessary industrialized infrastructure.

Indonesia’s competitiveness is growing, while Malaysia’s has overtaken Singapore as the favored location for cross-docking and bonded warehousing. Following that are the Philippines, Thailand, and Vietnam, where roads and laws are being improved.

Read more: Upcoming incentives create space for tech-led projects

Factors Affecting The Development of Industrial Warehouse Space for Lease in Southeast Asia

E-commerce

Rising eCommerce companies are rising to the challenge of meeting rising eCommerce demand. The market is continuously evolving, with new companies and existing organizations competing for new technology, human resources, and money. Investment possibilities are projected to increase at the current rate of the market.

E-commerce is expanding

According to the same survey, between 20 to 30% of Southeast Asian Internet users ordered a product online in the previous 30 days, roughly mirroring the UK and US figures. In Indonesia alone, 58 percent of respondents polled by McKinsey said they had increased their use of online grocery delivery services since the epidemic, with 18 percent saying it was their first time. Opportunities to improve eCommerce delivery and supply chain flow develop as more consumers grow accustomed to purchasing online.

With e-commerce and digital firms on the increase, warehouse logistics providers seeking to dominate must exploit market possibilities. E-commerce and logistics startups and organizations have an avalanche of potential innovations to exploit.

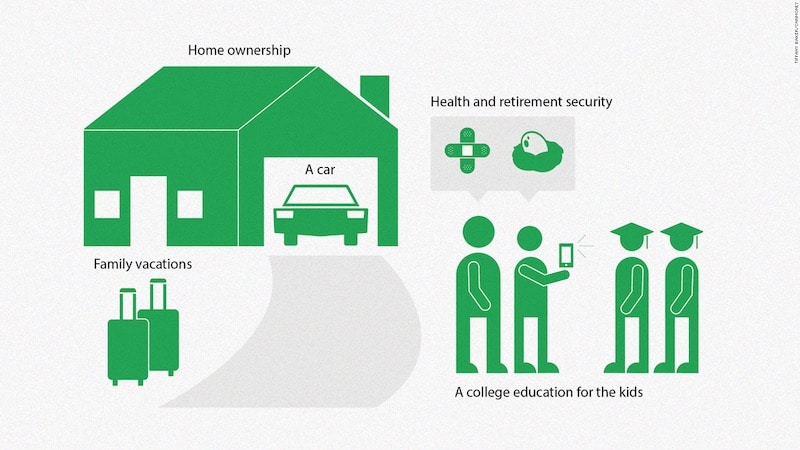

Middle class

Throughout developing Southeast Asia, a middle class is expanding. Asean’s long-term prosperity will be fueled by solid fundamentals, particularly a growing middle class. By 2030, 65 percent of the region’s population is predicted to be middle-class, with 60 percent under the age of 35. Asean’s burgeoning middle class is enthusiastic about the digital revolution. As a result, their expanding numbers are swiftly altering the game in every industry.

The rapidly expanding middle class is swiftly altering the game in every industry

Southeast Asia is predicted to contribute up to 70% of the world’s new consumer population during the next decade. By 2030, the region’s GDP will be dominated by tech-savvy millennial and Generation Z clients. As Southeast Asia’s digitalization accelerates, income from e-commerce is estimated to reach $172 billion by 2025.

The ever-expanding national middle-class community has a strong demand for food and beverages, luxury products, education, health care, leisure activities, and other consumer-related commodities, providing businesses with endless business potential and also creating opportunities for industrial warehouse providers. For example, Vietnam has a rapidly increasing middle class and has attracted numerous local caterers and merchants in recent years.

Innovative systems and logistics

The expansion of industrial warehouse space for lease in Southeast Asia has created a large demand for infrastructure building. The Asian Development Bank (ADB) estimates that ASEAN’s infrastructure investment needs will total $3.78 trillion between 2016 and 2030.

In addition to network services, such projects generally need financial and structural services during the borrowing process. Local professional service providers, in addition to infrastructure corporations, will have a chance to engage in regional infrastructure initiatives.

Infrastructural development in transportation, energy, utilities, and communications is in high demand in countries such as the Philippines and Indonesia. Populations in and around big cities are constantly increasing, as is the need for intelligent transit systems, water and electricity networks. Singapore firms can work with local industry to provide comprehensive infrastructure services.

Savills Industrial – One of the leading industrial real estate service providers in Southeast Asia

The leading industrial real estate service providers in Southeast Asia

Extensive experience

Following considerable expansion in the manufacturing and logistics industries, Savills Vietnam established a full-service solution for industrial real estate in 2017.

Manufacturing and warehouse advice is given by industry experts with extensive market knowledge and experience. Our services include everything from market access through investment, assessment, transactions, and disposal. We are proud to be the leader in the property market across Vietnam, and our best-in-class advisory services help people, corporations, and institutions make smarter property decisions.

Leading expertise

Savills Industrial has a team of highly qualified specialists who can provide advice on the warehouse or factory industrial viewpoint in Vietnam, as well as the best industrial properties for each firm’s characteristics and nature. Consumers will get expert help throughout the working process, as well as answers to questions about rental concerns and the resolution of any problems that arise. Specialists will accompany customers till they make a final selection.

Competitive prices

Although being a leading company in the rental real estate industry, Savills Vietnam always provides customers with many services at different prices to suit the situation of each company. Compared with other companies in the same industry, Savills’ prices are extremely competitive with many services, along with a team of reputable consultants.

Savills Industrial – Premium Industrial Warehouse Spaces

1.Ready-Built Factory for Sale in Phu Tho

- Location: Tam Nong, Phu Tho

- Total area: 5.5 ha

- Vacant area: 5.5 ha

- Price: Contact

- Key features:

- It is close to National Road 32A, near the confluence of the Red and Da rivers.

- The lease term is 2055. The cost is reasonable.

- Encouraging a management board

- Fully functional regions

Ready-Built Factory for Sale in Phu Tho

2.Industrial Land for Sale in Ha Noi

- Location: Thanh Tri District, Ha Noi City

- Total area: 3.75 ha

- Vacant area: 3.75 ha

- Price: Contact

- Key features:

- a great location for a variety of industries

- Convenient accessibility

- created a road system

- clear transfer deal structure.

Industrial Land for Sale in Ha Noi

3.Da Nang Excellent Quality Factory for Lease

- Location: Lien Chieu, Da Nang City

- Total area: 5,300 m²

- Vacant area: 4,000 m²

- Price: Contact

- Key features:

- Convenient connection

- Reliable investors

- Supportive government policies

- increase the number of high-tech industries.

Da Nang Excellent Quality Factory for Lease

Conclusion

Companies are becoming more aggressive in order to capitalize on the large opportunity as demand for industrial warehouse space for lease in Southeast Asia develops rapidly throughout the region. As a result, international corporations are investing strategically in regional logistics networks, such as new distribution facilities, automated warehouses, and so on.

Savills Industrials is proud to be Vietnam’s global supplier of industrial real estate services. In the current economy, we are willing to help our clients evaluate whether renting or buying their storage facility or industrial property is the best solution. We deliver superior consulting services from experienced professionals with in-depth market understanding through a team of top professionals in Vietnam. If you want to lease a small warehouse with the aid of specialists, call Mr. John Campbell right now!