In the ever-evolving intersection of real estate and finance, sale-leaseback transactions have emerged as a strategic financial instrument, providing businesses with a distinctive approach to unleash the potential locked within their real estate assets. This financial maneuver involves selling owned properties and subsequently entering into a leaseback arrangement, enabling the seller to retain operational use by becoming the tenant. This guide aims to demystify sale-leaseback transactions, offering a clear definition and shedding light on its significance in corporate finance.

What is a Sale-Leaseback Transaction?

A sale-leaseback is a financial arrangement where a business entity, typically the owner-occupant of a property, sells the property to an investor and concurrently leases it back for an agreed-upon period. This strategic move allows the property owner to release capital tied to real estate holdings while maintaining operational use. The transaction comprises two key elements: the sale of the property and the subsequent leasing of the same property by the original owner.

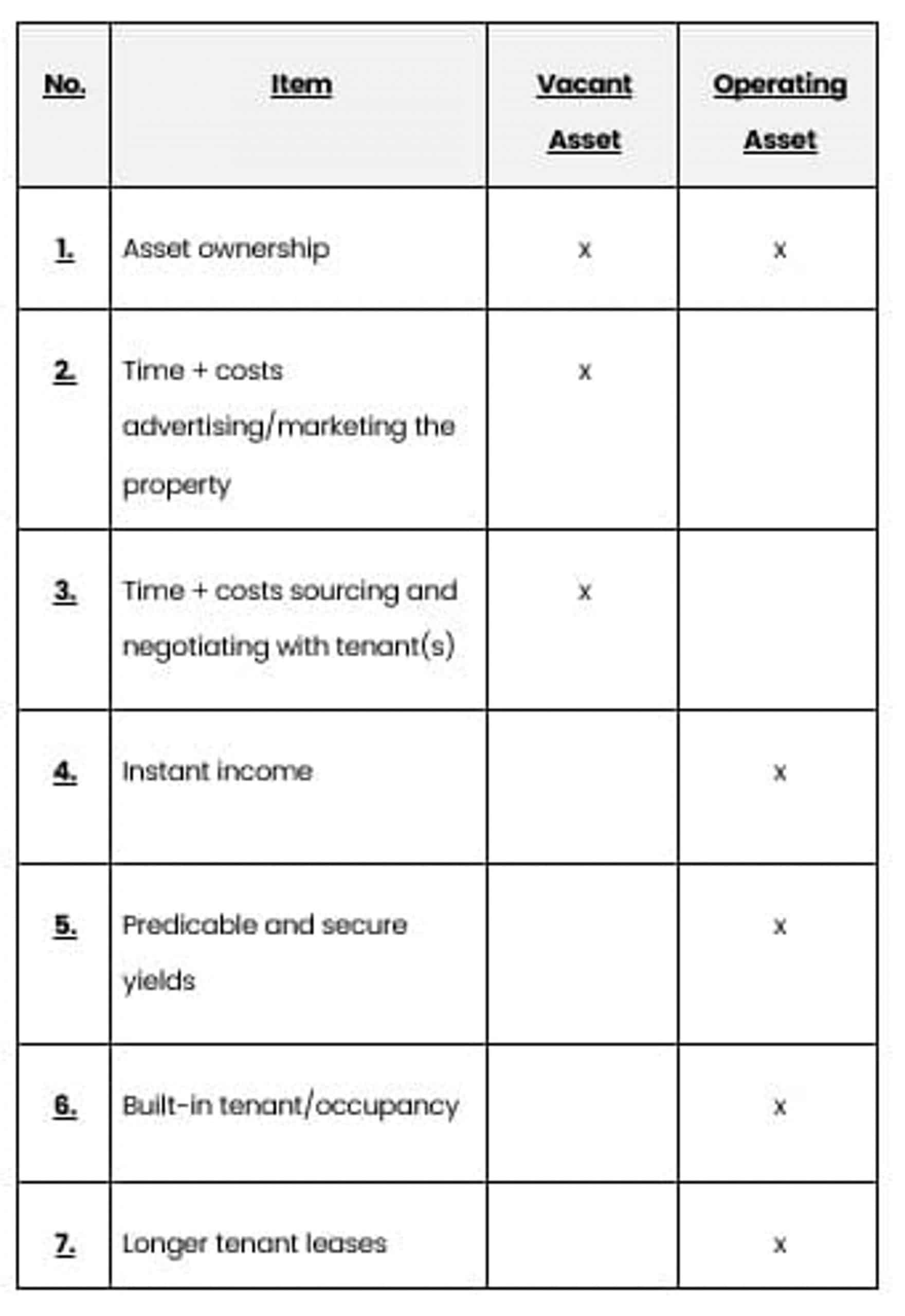

Vacant Asset Acquisition vs Sale-Leaseback/Operating Asset Acquisition

Industrial Output in Vietnam

As a pivotal player in the global economic landscape, Vietnam has witnessed substantial growth in its industrial output, contributing significantly to its economic development. This section offers an overview of industrial output trends in the country, illuminating the factors influencing this critical aspect of its economic performance.

Overview of Industrial Output Trends

Vietnam’s industrial output has displayed noteworthy trends in recent years, showcasing the dynamism and resilience of its manufacturing sector. Delving into the trajectory of industrial production involves examining key indicators such as year-on-year growth, sector-specific contributions, and the impact of external factors.

Economic Factors Influencing Industrial Output

Several economic factors play a pivotal role in shaping the industrial output landscape in Vietnam. These factors include:

- Global Economic Conditions: The interconnected nature of the global economy directly impacts Vietnam’s industrial output. Fluctuations in demand, trade dynamics, and economic conditions in major trading partners influence the performance of the country’s manufacturing sector.

- Domestic Consumption Patterns: The behavior of domestic consumers and their consumption patterns significantly contribute to industrial output. Shifts in consumer preferences, purchasing power, and market trends influence the production levels of various industries.

- Government Policies and Initiatives: Government policies and initiatives aimed at promoting industrial growth, innovation, and investment play a crucial role. Incentives, regulatory frameworks, and strategic plans shape the direction and intensity of industrial activities.

- Technological Advancements: The integration of advanced technologies into manufacturing processes enhances efficiency and competitiveness. Investments in technology, automation, and digitalization contribute to the evolution of industrial output trends.

- Supply Chain Dynamics: The efficiency and resilience of supply chains impact industrial output. Disruptions or optimizations in the supply chain, both globally and domestically, can influence the production capacities of different industries.

Sale-Leaseback: A Financial Instrument

Sale-leaseback emerges as a strategic financial maneuver for businesses, particularly those with real estate assets not directly aligned with their core operations. This approach serves as a valuable mechanism, allowing companies to liberate capital entangled in their properties. The unlocked funds can then be strategically deployed for diverse purposes, including but not limited to expansion initiatives, debt reduction strategies, or other pivotal investments crucial for the business’s growth and sustainability.

Detailed Mechanics of Sale-Leaseback Transactions

The intricacies of a sale-leaseback transaction unfold through a series of well-defined steps:

- Initiation of the Transaction:

– The business that owns the property (seller/lessee) decides to pursue a sale-leaseback arrangement.

– Identifying suitable investors or landlords who are interested in acquiring the property and entering into a leasing agreement. - Sale of the Asset:

– The seller/lessee sells the property to the investor/landlord, transferring ownership rights. - Leasing Back the Property:

– Simultaneously with the sale, the seller/lessee enters into a sale leaseback agreement with the investor/landlord to retain the right to use the property. - Lease Terms and Payments:

– The lease agreement outlines the terms, duration, and rental payments.

– The seller/lessee becomes the tenant, paying regular lease payments to the new owner. - Benefits for Both Parties:

– The seller/lessee benefits by receiving an immediate cash injection from the sale of the property.

– The investor/landlord benefits by acquiring the property at a potentially lower than market value and securing a long-term lease with rental income.

In essence, the sale-leaseback strategy not only furnishes businesses with the flexibility to optimize their capital structure but also extends an enticing opportunity for investors to acquire ownership of income-generating properties featuring stable and committed tenants.

Sale-Leaseback in the Industrial Property Realm

– Applicability to Various Asset Types

The dynamics of sale-leaseback transactions extend their applicability to a diverse range of asset types within the industrial property domain. This strategic financial approach is not confined to a singular category but is adaptable to various assets, unlocking its potential benefits for businesses operating in the industrial sector.

– Focus on Industrial Land, Factories, and Warehouses

Within the spectrum of industrial properties, sale-leaseback transactions find particular relevance in the context of:

- Industrial Land:

– Sale-leaseback can be effectively employed for industrial land, enabling landowners to monetize their holdings while retaining operational usage through leasing arrangements. - Factories:

– Factories, being crucial components of industrial operations, can be subject to sale-leaseback strategies. Businesses owning manufacturing facilities can leverage this approach to optimize their capital structure. - Warehouses:

– Warehouses, integral to the supply chain and logistics, represent another asset type where sale-leaseback can be strategically applied. Owners of warehouse properties can unlock capital for strategic initiatives while continuing operational activities through leasing agreements.

The versatility of sale-leaseback transactions in industrial properties allows businesses to extract value from different facets of their operations, contributing to enhanced financial flexibility and efficiency.

Benefits of Sale and Leaseback

Benefits for the Seller/Lessee

- Immediate Capital Injection:

– Sale and leaseback provide businesses with an efficient means of unlocking capital tied up in real estate assets. The seller/lessee receives an immediate cash injection from the sale, enabling quick access to funds. - Financial Flexibility:

– By converting real estate holdings into liquid assets, businesses gain financial flexibility. This liquidity can be directed towards strategic initiatives such as expansion, debt reduction, or crucial investments aligned with business objectives. - Risk Mitigation:

– Sale-leaseback helps mitigate risks associated with property ownership. The seller/lessee transfers the burden of property management, maintenance, and market fluctuations to the investor/landlord, allowing the business to focus on core operations.

Benefits for the Investor/Landlord

- Acquisition at Potentially Lower Value:

– Investors benefit by acquiring the property at a potentially lower than market value. Sale-leaseback transactions often provide investors with an opportunity to secure income-generating assets at a favorable purchase price. - Stable, Long-Term Rental Income:

– Investors enjoy a stable and predictable income stream through long-term lease agreements. The seller/lessee, now the tenant, commits to regular lease payments, ensuring a consistent source of revenue for the investor/landlord. - Diversification of Portfolio:

– For investors, sale-leaseback offers diversification. By adding income-generating properties to their portfolio, investors can balance risk and return, enhancing the overall stability and resilience of their investment portfolio.

Transfer of Money and Allocation of Investments

- Strategic Capital Allocation:

– Sellers can strategically allocate the funds obtained from the sale to areas that align with business priorities. Whether it’s reinvesting in core operations, reducing debt, or pursuing new opportunities, the sale-leaseback structure provides flexibility in capital allocation. - Optimized Use of Resources:

– Sale-leaseback enables businesses to optimize the use of resources. Rather than holding significant capital in real estate, they can redirect these resources to areas that yield higher returns and contribute more directly to the company’s growth and success. - Enhanced Financial Agility:

– The transfer of money from the sale of real estate allows for enhanced financial agility. Businesses can swiftly respond to market dynamics, capitalize on emerging opportunities, and navigate economic uncertainties with a more agile and adaptable financial structure.

Frequently Asked Questions

Why consider a sale-leaseback?

A company might consider a sale-leaseback for various reasons:

- Unlocking Capital: To release capital tied up in real estate for strategic purposes like expansion or debt reduction.

- Financial Flexibility: To gain financial flexibility by converting property assets into liquid funds.

- Risk Mitigation: To transfer property management and market risks to the investor/landlord.

How is the lease factor calculated in a sale-leaseback?

The lease factor, representing the yearly interest rate embedded in the lease, is calculated by dividing the lease fee by the product of the lease period and the total of capitalized and residual expenses. The monthly lease factor is obtained by dividing the annual rate by 12.

What is the step-by-step process of a sale-leaseback?

The sale-leaseback process involves several key steps:

- Initiation: The business decides to pursue a sale-leaseback and identifies interested investors.

- Sale of the Asset: The seller sells the property to the investor.

- Leasing Back: Simultaneously, the seller enters into a lease agreement to retain the right to use the property.

- Lease Terms: The lease agreement outlines terms, duration, and rental payments.

- Benefits for Both: The seller gains immediate cash, and the investor acquires the property at a potentially lower value with a long-term lease.

How does an equipment sale-leaseback work?

In an equipment sale-leaseback, a company can fund equipment by selling it to an investor and then leasing it back. The company becomes the seller-lessee, borrowing the asset from the buyer-lessor. This provides additional cash liquidity and may offer financial and tax incentives to the investor.

Vietnam’s Industrial Sector Outlook

Vietnam’s industrial sector remains intricately tied to the ongoing supply chain migration, particularly as companies seek alternatives to the traditional manufacturing giant, China. This dependence is underscored by several key factors:

- Continued Supply Chain Shift: The trend of companies relocating their manufacturing operations out of China is anticipated to persist, contributing to Vietnam’s industrial growth. The diversification of supply chains is seen as a strategic move to mitigate risks and enhance resilience.

- Strategic Geopolitical Positioning: Vietnam’s strategic geographical location makes it an attractive destination for supply chain relocation. Its proximity to major markets, including Southeast Asia and the Pacific, positions it as a hub for efficient logistics and distribution.

- Government Initiatives: The Vietnamese government has actively promoted initiatives to attract foreign investment in the industrial sector. Incentives such as tax breaks, infrastructure development, and streamlined regulatory processes aim to facilitate the seamless integration of businesses into the local industrial landscape.

Savills Industrial Real Estate Services Perspective

Savills Industrial Real Estate Services provides a valuable perspective on Vietnam’s industrial sector outlook:

- Robust Demand for Industrial Spaces: Savills observes a sustained and robust demand for industrial spaces, driven by the influx of foreign direct investment (FDI) and the expansion of domestic businesses. This demand extends to various asset types, including factories, warehouses, and industrial land.

- Preparation for a Prosperous Year: Despite uncertainties in the global economic landscape, many landlords in Vietnam’s industrial sector are gearing up for a busy and prosperous year. The anticipation is rooted in the continuous flow of businesses seeking strategic relocation and expansion opportunities.

- Flexibility and Adaptability: In the face of economic insecurity, businesses are urged to consider flexibility and adaptability in their strategies. Savills emphasizes the importance of businesses evaluating their capital structure and optimizing their real estate assets, with sale-leaseback transactions being a notable avenue for achieving these objectives.

In conclusion, while uncertainties prevail in the global economic landscape, Vietnam’s industrial sector remains resilient, driven by supply chain migration trends. Savills Industrial Real Estate Services provides insights and guidance to navigate this dynamic landscape, supporting businesses in making informed decisions for sustained growth and success.