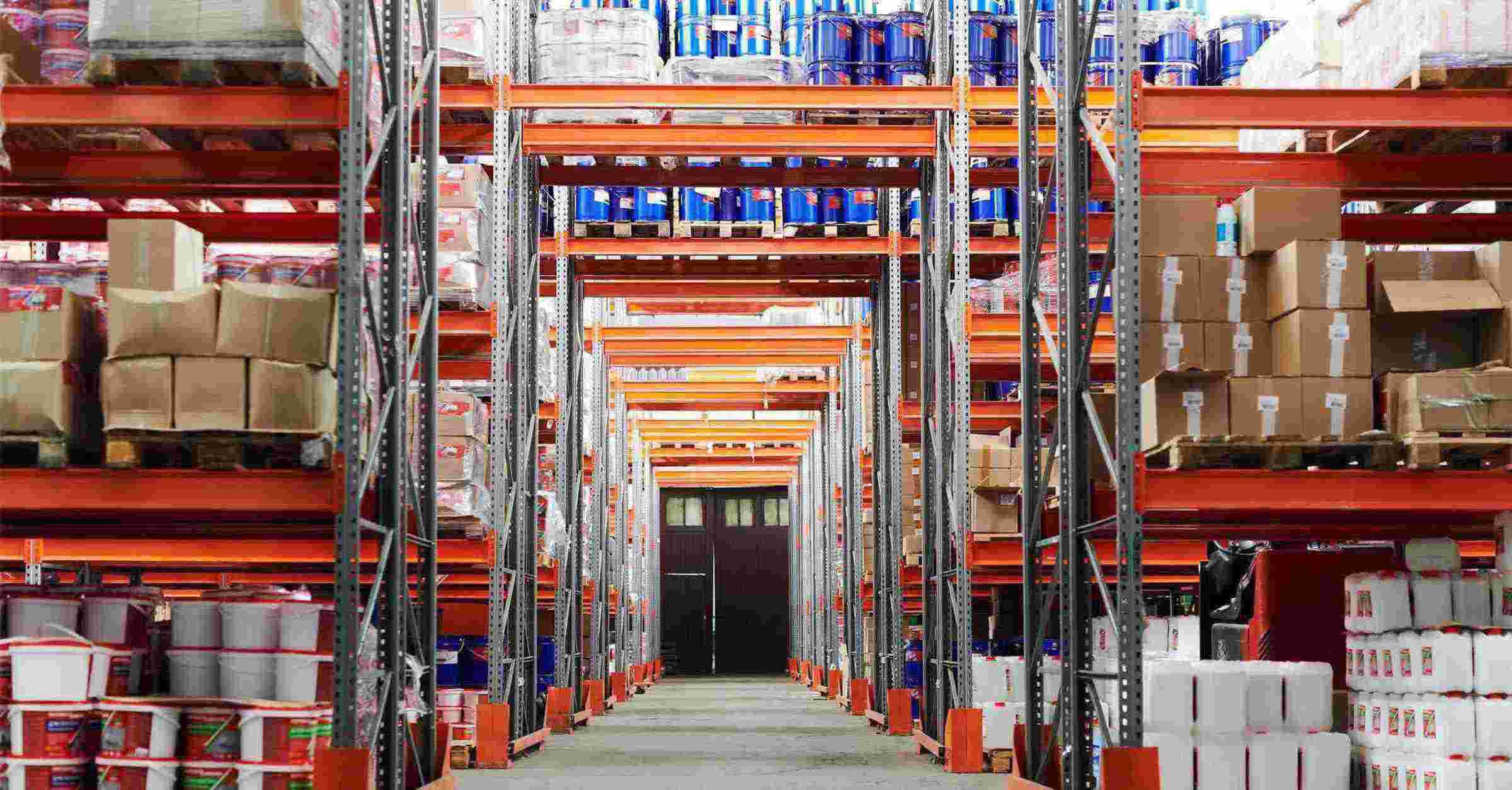

Industrial park leasing in Southeast Asia will most certainly remain one of the most potential industrial real estate investment for the next decade.

Industrial Park Leasing in Southeast Asia

Online shopping/E-commerce

Southeast Asia’s ecommerce sales will hit $89.67 billion in 2022, a $15.31 billion rise over last year. Southeast Asia’s development stands out even more in light of the fact that most other areas will only witness modest gains this year. The region’s 20.6 percent expansion in 2022 will be the world’s largest. Five countries in the area will rank in the top ten in terms of retail e-commerce sales growth: the Philippines, Indonesia, Vietnam, Malaysia, and Thailand.

During the epidemic, Southeast Asia experienced a spike in the usage of digital services such as e-commerce, food delivery, and online payment, according to a 2021 industry study from Google, Temasek Holdings, and Bain & Company.

With the rise of e-commerce and digital enterprises, industrial park providers wishing to dominate must seize market opportunities. There is an avalanche of possible advances for e-commerce and logistics businesses and organizations operating in the industrial park leasing in Southeast Asia to exploit.

Increased of Middle Class Status

The ASEAN middle class is ecstatic about the digital revolution. As a result, their growing number is rapidly changing the game in every business. That led to the growth of industrial park leasing in Southeast Asia.

The increasing national middle-class society has a huge need for food and beverages, luxury products, education, health care, leisure activities, and other consumer-related commodities, which requires lots of industrial parks. The trend of the middle class in the region is “100%, 120% online.” The reality provides businesses with unlimited business opportunities as well as opportunities for industrial warehouse providers. Vietnam, for example, has a fast growing middle class and has recently attracted a slew of local caterers and retailers.

The application of modern technology

The increase in industrial park leasing in Southeast Asia has created a high demand for higher technology in manufacturing. The Asian Development Bank (ADB) estimates that ASEAN’s investment needs will reach $3.78 trillion between 2016 and 2030.

During the financing process, such projects typically require financial and structural services in addition to network services. In addition to modern technology, local professional service providers will have opportunities to participate in regional initiatives.

Transportation, energy, utilities, and communications infrastructure are in great demand in nations such as the Philippines and Indonesia. Populations in and around major cities are always growing, as is the demand for sophisticated technology to optimize daily operations.

Reasons Why Savills Industrials is The Best Industrial Park Real Estates Provider in Vietnam

Vietnam’s best consulting team

Vietnam – the leading country in Southeast Asia

According to a recent record, with an average of 104 purchase orders per person each year, Vietnam is the leading country in Southeast Asia for online transactions. With strategic analysis proving the emergence of Southeast Asia’s e-commerce and e-postal sectors, it is assumed that the Vietnamese industry is one of the most promising, owing to sustained and evident growth in recent years in industrial park leasing in Southeast Asia.

Experts in the Real Estate Industry

Following significant growth in industrial park leasing in Southeast Asia, Savills Vietnam created a full-service industrial real estate solution in 2017.

Industry specialists with deep market knowledge and expertise provide industrial real estate services. Our services range from market entry to investment, including appraisal, transaction, and disposal. We are delighted to be the market leader in Vietnam, and our best-in-class advisory services assist individuals, organizations, and institutions in making better property decisions.

Competitive Prices

Despite being a market leader in the rental real estate business, Savills Vietnam constantly offers a wide range of services at various industrial leasing costs in Southeast Asia to fit the needs of each organization. Savills Industrial’s offers are highly competitive when compared to other organizations in the same field, with various services and a staff of recognized consultants.

Read more: The Rising Trend of Small size Warehouse for Lease in Southeast Asia

Available Industrial Park of Savills Industrial in Vietnam

Industrial Land for Lease in Vinh Phuc

– Total area: 248ha

– Vacant area: 152ha

– Price: Contact

– Key features:

+ Ideal for IT, mechanical products, consumer goods, construction materials, food processing, chemicals, and pharmaceuticals.

+ The IP is located along Ring Road 4 and the Ha Noi-Hai Phong-Con Minh Economic Corridor.

Industrial Land for Lease in Vinh Phuc

Industrial Land for Lease in Hai Phong

– Total area: 1,329ha

– Vacant area: 218ha

– Price: Contact

– Key features:

+ Closely linked to the transportation network.

+ Various functional subzones include the seaport area and logistics warehouse, the petroleum jetty, industrial land, and so forth.

+ The technical infrastructure is being created in a timely and contemporary manner.

Industrial Land for Lease in Hai Phong

RBF in Nhon Trach – Dong Nai

– Total area: 38,411m²

– Vacant area: 5,888m²

– Price: Contact

– Key features:

+ Emerging FDI destinations

+ Surrounded by 5 national highways (1A, 1K, 20, 51, and 56).

+ Ideal for manufacturers of plastic products, light industry, and electrical and electronic equipment assemblers

RBF in Nhon Trach – Dong Nai

Other factory that’s available for lease:

Factory for lease in Nhon Trach 3, Dong Nai

Factory for lease in Nhon Trach 5, Dong Nai

Factory for lease in Duc Hoa, Long An

2-storey ready-built factory for lease in Long An

Conclusion

In the last few years, industrial park in Vietnam has attracted foreign investors due to the region’s lower costs, high skill levels, and rising domestic consumption. Savills Industrial Vietnam is the leading industrial real estate team in Vietnam and has been providing best-in-class consultancy since 1995. Everything we undertake on behalf of developers, investors, landowners, corporate occupiers, logistics businesses, and public sector organizations is supported by the Industrial Savills research team’s comprehensive experience and up-to-date insight. We value customer communication and on-time delivery in all cases.

Call Savills Industrial right now to discuss your business expansion goals in further details.