Rising land prices and factory and warehouse rents mean more investors are considering the potential of acquiring operating assets or investing in sale-leaseback transactions. With this transaction becoming more popular amid the pandemic, it is vital to understand what is a leaseback in industrial real estate? Follow this article for vital information when renting a warehouse or factory in Vietnam.

The actual developments in the market and the survey of the Vietnam Association of Real Estate Brokers show that the occupancy rate in industrial parks is now over 74%; The average rent of factories nationally is about $2-$5 USD/m2 and the purchase price of industrial land with infrastructure ranges from $130-$250 USD/m2 and can continue to increase in the coming time.

In Q1/2021, the industrial real estate market was very active in some localities with potentials and strengths in industrial development, including Long An, Dong Nai, Binh Duong, Thanh Hoa, Hai Phong, and Bac Giang.

Mr. John Campbell said that the surge in demand for land, factories and warehouses caused rents in industrial parks near cities to escalate. The surge in demand for industrial land leasing can also be explained by the development of infrastructure and access to and connection of new locations, roads, piers and airports.

What is a leaseback? Leaseback, short for “sale-and-leaseback,” is a financial transaction where one party sells an asset and leases it back for an extended period; they retain its use but not its ownership.

To put it in another perspective, a person sells an asset to a second party (the buyer/lessor) and it is then rented back by the seller/lessee from the buyer/lessor. Fixed assets, most notably real estate and other permanent capital goods such as airlines and trains, are typically traded via this mode of transaction.

In industrial real estate, a sale leaseback is an excellent solution for a company to free up capital while ensuring business or manufacturing operations go uninterrupted. It provides an alternative for companies to leverage their real estate assets to raise money without taking out a high-interest loan from the bank.

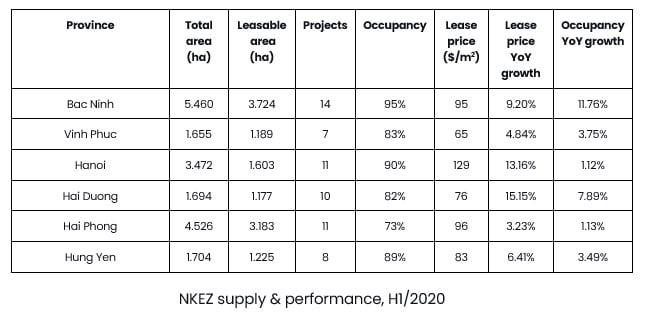

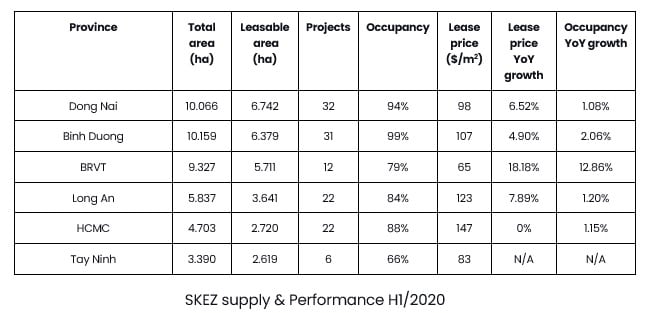

In Asia-Pacific economies, industrial real estate has been and continues to be a resilient asset class. Since 2020, industrial real estate has seen a significant uptick in gross vacancy rates, resulting in a scarcity of supply and demand for new industrial parks in certain key areas. Specifically in North & South Key Economic Zone:

With demand continuing to outstrip production, there is a clear need for increased supply in key manufacturing sectors. The majority of leasing deals in the first half of 2020 are the result of ventures and agreements that began last year. Meanwhile, companies that already have a presence in Vietnam are making new leases and are looking to increase demand. Travel restrictions between countries impacted the need to access the market, causing major foreign buyers to pause land surveys and several leases.

Before commencing, both the seller/lessee and the buyer/lessor must weigh the benefits and drawbacks of a selling leaseback deal. In general, a lease-buyback deal presents all sides with rational economic benefits.

However, the parties must take steps to follow accounting principles or else the leaseback agreement will fail.

Pros for the Buyer-Lessor

Pros for the Seller-Lessee

Cons-for the Buyer-Lessor

Cons for the Seller-Lessee

Despite growing success, sale-leaseback agreements are still underutilized in Vietnam. Many suppliers and manufacturing and logistics firms are unaware of this approach as a possible source of funding.

Innovative programs and strategies would be critical in accommodating the influx of new acquisitions and relocations. The position of new ventures is critical since the majority of manufacturing and logistics demand is still concentrated in core industrial provinces or tier 1 projects (major Southern/ Northern cities and provinces).

Tier 2 projects – which are emerging industrial areas in surrounding provinces, will aim to encourage foreign investment by offering more affordable lease rates and a greater supply of vacant property, but more investment in infrastructure and transportation network ties will be needed if these new provinces are to expand.

John Campbell, Savills Vietnam Industrial Services Manager shared: “Rising lease prices are a growing concern for low value-add manufacturing or low margin industries such as textiles and furniture. The current rates are, for the most part, still acceptable to multinational high-value manufacturers such as hi-tech, supporting industries and automotive. Should prices continue on the same trajectory they have been on since 2018 and moving forward, regional competitiveness may slide unless the more industrial land supply is deployed in key locations to accommodate demand and stabilize prices.”

For Vietnam, the highly effective pandemic response to both outbreaks, a robust and growing middle class, stable business environment, labour force, infrastructure spending, corporate income tax incentives, and recent FTAs, are all contributory factors to claiming post-pandemic opportunities.

Moreover, the sale and leaseback mechanism will be used more by companies as an enticing solution to conventional funding structures, reinvesting resources in core businesses and development goals while retaining ownership of the asset.