Rising land prices and factory and warehouse rents mean more investors are considering the potential of acquiring operating assets or investing in sale-leaseback transactions. With this transaction becoming more popular amid the pandemic, it is vital to understand what is a leaseback in industrial real estate? Follow this article for vital information when renting a warehouse or factory in Vietnam.

Overview

The actual developments in the market and the survey of the Vietnam Association of Real Estate Brokers show that the occupancy rate in industrial parks is now over 74%; The average rent of factories nationally is about $2-$5 USD/m2 and the purchase price of industrial land with infrastructure ranges from $130-$250 USD/m2 and can continue to increase in the coming time.

In Q1/2021, the industrial real estate market was very active in some localities with potentials and strengths in industrial development, including Long An, Dong Nai, Binh Duong, Thanh Hoa, Hai Phong, and Bac Giang.

Mr. John Campbell said that the surge in demand for land, factories and warehouses caused rents in industrial parks near cities to escalate. The surge in demand for industrial land leasing can also be explained by the development of infrastructure and access to and connection of new locations, roads, piers and airports.

What is a leaseback in industrial real estate?

What is a leaseback? Leaseback, short for “sale-and-leaseback,” is a financial transaction where one party sells an asset and leases it back for an extended period; they retain its use but not its ownership.

To put it in another perspective, a person sells an asset to a second party (the buyer/lessor) and it is then rented back by the seller/lessee from the buyer/lessor. Fixed assets, most notably real estate and other permanent capital goods such as airlines and trains, are typically traded via this mode of transaction.

In industrial real estate, a sale leaseback is an excellent solution for a company to free up capital while ensuring business or manufacturing operations go uninterrupted. It provides an alternative for companies to leverage their real estate assets to raise money without taking out a high-interest loan from the bank.

The current industrial real estate setting

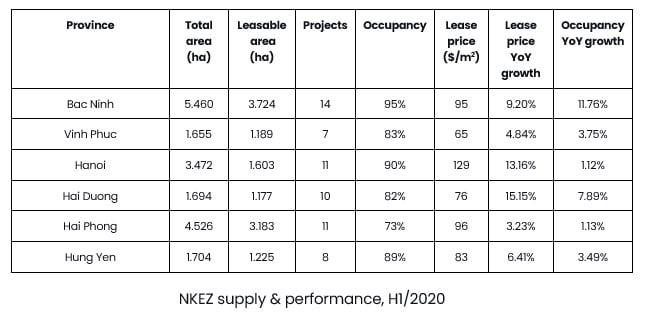

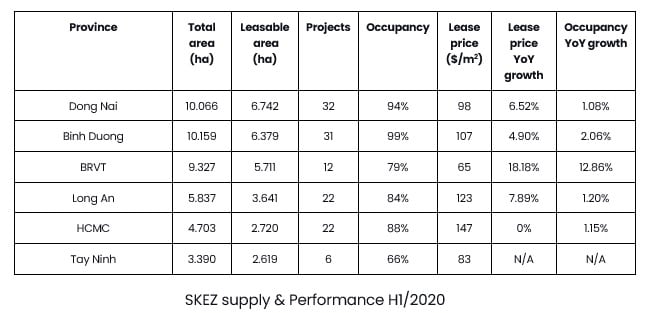

In Asia-Pacific economies, industrial real estate has been and continues to be a resilient asset class. Since 2020, industrial real estate has seen a significant uptick in gross vacancy rates, resulting in a scarcity of supply and demand for new industrial parks in certain key areas. Specifically in North & South Key Economic Zone:

With demand continuing to outstrip production, there is a clear need for increased supply in key manufacturing sectors. The majority of leasing deals in the first half of 2020 are the result of ventures and agreements that began last year. Meanwhile, companies that already have a presence in Vietnam are making new leases and are looking to increase demand. Travel restrictions between countries impacted the need to access the market, causing major foreign buyers to pause land surveys and several leases.

Pros and Cons of leasebacks

Before commencing, both the seller/lessee and the buyer/lessor must weigh the benefits and drawbacks of a selling leaseback deal. In general, a lease-buyback deal presents all sides with rational economic benefits.

However, the parties must take steps to follow accounting principles or else the leaseback agreement will fail.

Pros for the Buyer-Lessor

- Cash Flows: The buyer-lessor may receive rental income from the seller-lessee under a selling leaseback. As a result, the buyer-lessor establishes a known return on the asset purchased. The current value of the asset’s return must outweigh the cost of acquisition. As a result, what is a leaseback can improve is the buyer-financial lessor’s status.

- Benefits of Ownership: The buyer-lessor retains the property and will benefit from it before the lease ends. The buyer-lessor will also depreciate the property to claim a non-cash tax deduction. Finally, the buyer-lessor has the power to repossess the estate if the seller-lessee fails to make lease payments. This allows the buyer-lessor to re-lease the property to a new lessee at a higher rent.

- Lease Customization: The buyer-lessor may draw up special lease conditions in non-traditional documentation to satisfy particular inquiries that are not usually present in regular leasing documents. This enables buyers to have contracts that guarantee high returns. Including a personal or business pledge aids in subsequent resale.

- Built-in Tenant: When the buyer-lessor purchases the assets, they inherit a built-in tenant with a track record of success at the site. When the contract suits the tenant’s business model, the tenant is more likely to remain for an extended period of time.

Pros for the Seller-Lessee

- Raising Capital: A sale-leaseback to the seller-lessee to collect sale proceeds from the buyer-lessor, potentially increasing the buyer-lessor’s liquidity. This type of transaction can free up available cash for the buyer-lessor. Naturally, a seller-lessee can use this money for other purposes while still retaining its use and enjoyment of the asset. A cash-strapped seller-lessee will find this arrangement especially useful.

- More Effective Financing: The seller-all-in lessee’s rate for a leaseback is lower than mezzanine funding and other schemes. Furthermore, for businesses with bad credit, an SLB can be the most cost-effective option.

- Transfer of Tax Ownership: The buyer-lessor receives tax ownership and other duties due to the selling leaseback. Simultaneously, the seller-lessee will subtract the lease fees in the year they incurred. These deductions could be more beneficial than the owner’s depreciation and interest cost deductions.

- Full Financing: A SLB may be structured by the parties to fund up to 100% of the asset’s valuation. The majority of mortgages provide just 65% to 80% financing. As a result, the seller-lessee will contribute less equity to the lease and redirect the cash liquidity elsewhere.

Cons-for the Buyer-Lessor

- Market Risk: The asset’s value could fall faster than expected. In reality, once the lease expires, the asset can become disabled, necessitating a write-off.

- Seller Default: If the seller fails to honour the contract, the buyer is left without a tenant. Depending on the business, the buyer can have difficulty locating a new occupant. There is, however, the possibility of selling the building to an owner/user.

- Property Maintenance Is Needed: The standard lease arrangement is a NNN (triple net lease), which makes the lessee liable for all day-to-day operations over the lease period. However, the lender would also be liable for ensuring that the purchaser owes property taxes on time and for checking the property’s insurance policy.

Cons for the Seller-Lessee

- Accounting: The seller-lessee is unlikely to take the lease off the balance sheet. Off-balance-sheet leases with terms of less than one year are now typically allowed. Short-term rentals, in particular, should be reported in the financial statement footnotes rather than on the balance sheet. All other rents, on the other hand, must be noted on the balance sheet.

- Non-Optimum Price: The asset can have physical flaws or features that preclude it from selling at the best possible price. Poor market conditions, such as a lack of demand or an abundance of supply, may reduce the purchase price.

- Loss of Flexibility: Without the prior permission of the buyer, the seller lacks the freedom to amend, discontinue usage of the land, or alter the asset. What is a leaseback will also limit is the seller’s ability to move the leasehold interest. The leasehold interest may be negotiated differently at the outset of the lease.

In Vietnam, leaseback industrial real estates are expected to thrive

Despite growing success, sale-leaseback agreements are still underutilized in Vietnam. Many suppliers and manufacturing and logistics firms are unaware of this approach as a possible source of funding.

Innovative programs and strategies would be critical in accommodating the influx of new acquisitions and relocations. The position of new ventures is critical since the majority of manufacturing and logistics demand is still concentrated in core industrial provinces or tier 1 projects (major Southern/ Northern cities and provinces).

Tier 2 projects – which are emerging industrial areas in surrounding provinces, will aim to encourage foreign investment by offering more affordable lease rates and a greater supply of vacant property, but more investment in infrastructure and transportation network ties will be needed if these new provinces are to expand.

John Campbell, Savills Vietnam Industrial Services Manager shared: “Rising lease prices are a growing concern for low value-add manufacturing or low margin industries such as textiles and furniture. The current rates are, for the most part, still acceptable to multinational high-value manufacturers such as hi-tech, supporting industries and automotive. Should prices continue on the same trajectory they have been on since 2018 and moving forward, regional competitiveness may slide unless the more industrial land supply is deployed in key locations to accommodate demand and stabilize prices.”

For Vietnam, the highly effective pandemic response to both outbreaks, a robust and growing middle class, stable business environment, labour force, infrastructure spending, corporate income tax incentives, and recent FTAs, are all contributory factors to claiming post-pandemic opportunities.

Moreover, the sale and leaseback mechanism will be used more by companies as an enticing solution to conventional funding structures, reinvesting resources in core businesses and development goals while retaining ownership of the asset.