The damage caused by the pandemic has resulted in substantial commercial property loss. According to Savills’s report, office real estate sales in Asia-Pacific were down 59% year on year in the second quarter of 2020. The number for retail real estate is even more alarming, at 68%. The transactions in the commercial real estate market and the logistics and transportation industry declined by just 24%, indicating that this sector remained relatively resilient during the pandemic.

“Amid travel restrictions, industrial property sector activity in 2020 revolved around companies in Vietnam expanding or relocating their production. Last year has also seen some key deals and the emergence of distressed assets and facilities for sale & leaseback. Regarding leasing, strong demand exists for ready builds as suppliers are more conservative to make long-term land lease commitments or are relying on short-term contracts with their customers.” – Mr. John Campbell commented.

During the pandemic, we witnessed more manufacturers and logistics players realize the full potential of their real estate assets as means to raise capital without interrupting operations. As opposed to taking out high-interest loans from the bank, the sale-leaseback method serves as an interesting alternative for CFOs to consider.

What is a lease buyback deal?

Lease buyback, or sale-leaseback, is a common strategy for businesses that buy real estate or industrial land and convert their properties into cash to fund operations. It is a very particular form of a financial instrument where one party (the seller/lessee) that owns an asset sells the asset to the second party (the investor/landlord).

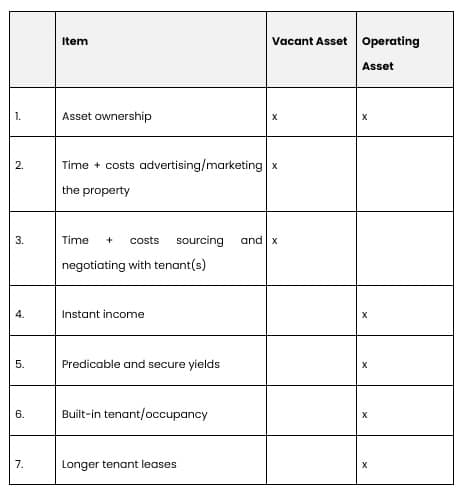

Then, the seller leases the asset back from the buyer, therefore the seller becomes the tenant, and the investor is the landlord. The benefit for the seller is that they can raise capital without moving or interrupting business operations. Furthermore, they are selling the asset at the current market rate, which is likely to be higher than its initial purchase cost.

The investor benefits from acquiring an operating asset that produces an instant return on investment in the form of monthly rental payments. Therefore, they don’t need to spend cash on leasing or marketing campaigns to source potential tenants.

Table 1: Vacant Asset Acquisition vs Sale-Leaseback/Operating Asset Acquisition

Read more: 5 Effective Ways for Foreign Investors to Invest in Vietnam Real Estate 2022

Types of sale-leaseback

There are two types of selling and leaseback transactions in the industry: operational leases and capital leases. A selling and leaseback contract is often structured as an operating lease but will be treated as a capital lease in some cases.

Typically, a sale and leaseback is a capital lease if the lease has a buyback provision or a buyback deal available at a discount price or the lease value exceeds 90% of the property’s value.

Bypassing any or more of the risk of running expenses to the tenant, the landlord gains the apparent benefit of some defence from operating cost inflation. In general, the various methods of managing operating expenses are defined by four distinct categories of leases, which are as follows:

- Gross Lease: The tenant pays rent and the lessor offers to cover all living expenses. The occupant can pay for exceptional repairs if the contract requires them to do so.

- Net Lease: The occupant is responsible for the rent and the running costs, depending on whether the contract is a single net lease, a double net lease, or a triple net lease.

- Hybrid Lease: Include both gross and net rents, in which the occupant and owner share the cost of building operations.

- Percentage Lease: This depends on the lessee’s gross or net profits. A percentage lease requires a minimum rent to cover the lessor in the event of a tenant’s closure.

What can be used to obtain a sale-leaseback?

Businesses that use sale-leasebacks usually have high-cost fixed assets, such as real estate or costly pieces of equipment. That is why real estate companies choose sale-leaseback financing; property is the ultimate high-cost fixed asset.

However, businesses in various other sectors, including construction, logistics, engineering, and agriculture, also rely on sale-leasebacks. Large trucks use heavy equipment, and other registered rolling stock all receive plenty of use. Collections of small objects, even though they add up to a considerable number, are unlikely to suffice.

How it works

Following the acquisition of an asset, an investor commits to a lease with the seller where they rent the property back at an agreed-upon cost. The usual lease term for sale-leasebacks is from 5 to 10 years, to ensure there is enough time for the investor to attain their investment yield. In Vietnam, investment yields for these transactions can range between 8-11%.

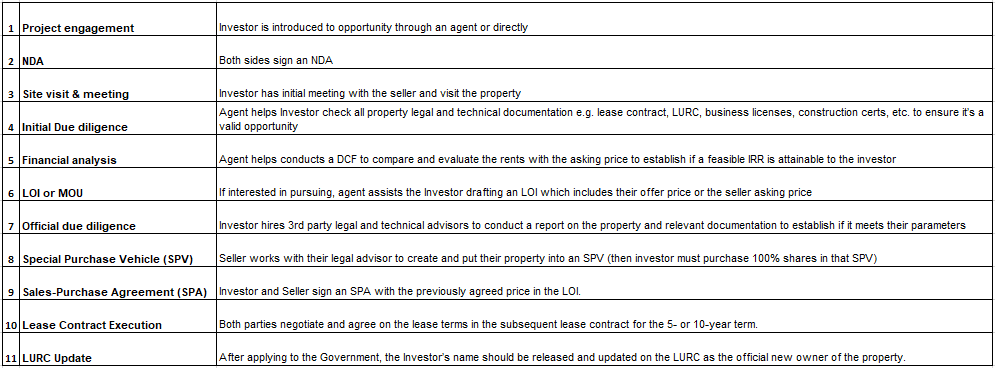

Sale-leasebacks are effectively two transactions in one: the first transaction is the sale or purchase of the asset. Once both parties sign a Sale-Purchase Agreement (SPA) to close the purchase, they must then also sign a Lease Contract.

The SPA and Lease Contract are tightly connected, as the selling price stated in the SPA must enable the investor to achieve an attractive yield against the monthly rental rates outlined in the Lease Contract.

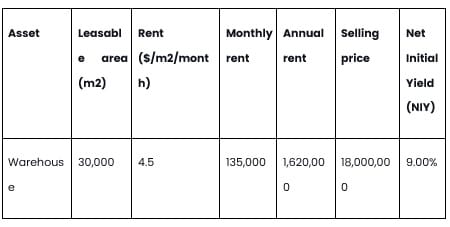

As a basic example, if an investor buys a 30,000 m2 warehouse at US$18 million and leases it back to the previous owner/tenant at US$4.5/m2/month, a net initial yield (NIY) of 9% is attainable in the first year.

Note that this is a rental yield. To estimate the actual Internal Rate of Return (IRR) of their investment, the investor would need to conduct a Discounted Cash Flow (DCF). The IRR yield would be lower than the rental yield as it must take other costs into consideration such as maintenance and operating costs of the asset.

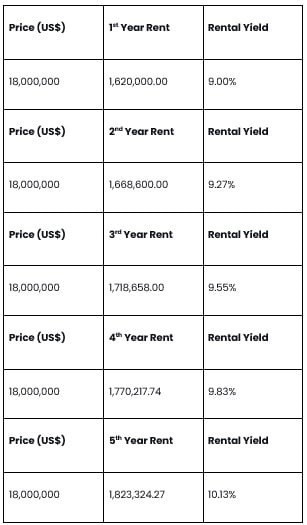

One other important consideration is the yearly rental increases stated in the lease contract. Whether it is a 3% or 5% increase after the first year will have a significant impact on the investor’s yield at the end of the 5 or 10-year term.

For example, if there is a 3% annual rental increase after the first year over a 5-year lease term, the result will be as follows:

Due to the time and number of agreements to be negotiated and signed, it is advised that a professional real estate agency is used to assist both parties with the transaction, preferably an agency with experience successfully closing sale-leaseback transactions.

The agent can help determine if the selling price is in line with the current market. The agent will also play a crucial role in drafting the new Lease Contract and will need to ensure all terms and yearly rental increases are reasonable and in accordance with the market.

Furthermore, these terms will need to be suitable for the Lessee and provide the investor or Lessor with a satisfactory rental yield.

General Steps in a Sale-Leaseback

Sale-Leasebacks in Vietnam

Although increasing in popularity, sale-leasebacks are still underutilized in Vietnam. Many manufacturers and logistics companies are not aware of this method as a potential means of financing. However, some international and even local players are starting to pave the way.

The first high-profile sale-leaseback in Vietnam’s industrial market was DKSH’s warehouse in Binh Duong in 2017. In 2018, Mapletree Logistics Trust from Singapore invested US$43 million in Unilever’s 66,800 GFA warehouse in Binh Duong.

The property was leased back to Unilever on a 10-year term, providing a net initial yield of 8.3% for Mapletree. As the trend continues, keen investors are actively seeking industrial properties for sale-leaseback. In 2020, Savills Vietnam brokered a successful sale-leaseback of 36,000 m2 GFA of warehouse space in Di An, Binh Duong. The property was purchased for over US$20 million and leased back to the tenant on a 5 + 5-year lease term and providing a net initial yield of over 9% for the investor.

What happens after the lease term ends?

A sale-leaseback is usually long-term, which provides enough time to determine what to do after the lease expires. There are options after the sale-leaseback contract expires, depending on how the two parties arranged the deal. If the sale-leaseback arrangement is a capital lease, the lessee can own the equipment free and clear at the end of the lease period, with no more obligations.

Who should undertake a Sale-Leaseback

With the pandemic’s looming effect on the economy, companies are increasing their financial savings for urgent needs and core operations. The number of sellers of real estate and logistics companies is increasing, resulting in an accumulation of cash. By using leasebacks, they are allowed to keep their facilities.

Businesses that often utilize sale-leasebacks are typically the ones that possessed high-cost, fixed assets, such as real estate and industrial pieces of equipment. Undertaking sale-leasebacks are often been blue-chip companies, MNCs (Multinational Companies), institutional funds, industrial developers, and landlords.

Read more: Potential Investment In Vietnam Warehouse Leasing Market

Conclusion

Demand for land, factories and warehouses has surged, causing rent in industrial zones near big cities to escalate. By June 2020, the nation will have 336 industrial zones covering about 97,800 hectares. Whereas 261 industrial areas are operational, the remaining 75 are undergoing site clearing and preparation for construction. The occupancy rate hit 76% of all functioning industrial parks.

Rising prices remain a concern for low-value and low-margin manufacturing sectors such as textiles and furniture. Current foreign exchange rates remain acceptable for high-value multinational manufacturers operating in the tech sector, high-tech support and automated machinery.

Despite the effects of the pandemic on the entire economy in general, the industrial land/industrial real estate market is still on the upswing. The land rental cost of the industrial zone is recorded to have increased and become a bright spot given the current market situation.

With limited supply in other segments such as commercial housing, offices, retail. One of the reasons for this is that cash-strapped companies are looking for funding to help them survive. There is renewed interest in the sale and leaseback financial structure as it can help with cash flow and play a vital role in the strategic expansion.