With recent consecutive fluctuations, the economy has also been affected to a certain extent. As a result, investors are even more cautious when moving investment funds to other nations. So how do you evaluate which countries are the best to invest in? Is Vietnam one of the top 20 best countries to invest in?

Global Foreign Direct Investment (FDI) is expected to decline by 2023 as the outbreak of the Russian-Ukrainian war has since been followed by numerous crises that have sent energy and food prices soaring. When the whole world was still reeling from the effects of the pandemic, the war broke out like the last straw, causing financial instability and debt pressure on many countries. This has had a significant impact on the economies of many countries as well as global FDI flows.

Hesitancy and risk aversion among investors will likely have a great influence on causing FDI to decrease significantly globally. Regardless, the top 20 countries to invest in in today’s article are assessed according to their development potential and are not necessarily related to the countries receiving the most FDI. According to the Global Investment Report 2022 of the United Nations Conference on Trade and Development (UNCTAD), the total foreign investment capital (FDI) reached $1.58 billion USD, an increase of 64% compared to 2020. Foreign investment inflows continue to favor developing countries, with a total capital of up to $837 billion USD.

As mentioned, FDI inflows tend to go to developing countries, especially in sustainable development sectors (SDGs), and have specifically increased by about 70% compared to the same period last year. Top 20 best countries to invest in, both developing and developed, by loosening and adjusting policies to stimulate foreign investment flows.

The recovery in FDI growth was largely attributed to the financing of projects in the renewable energy sector. According to UNCTAD’s Global Investment Report, fields such as infrastructure, industrial real estate, agriculture, food, etc. have seen more positive changes. However, infrastructure projects and investment real estate are projects with long-term risks, so FDI in projects has not necessarily made breakthroughs.

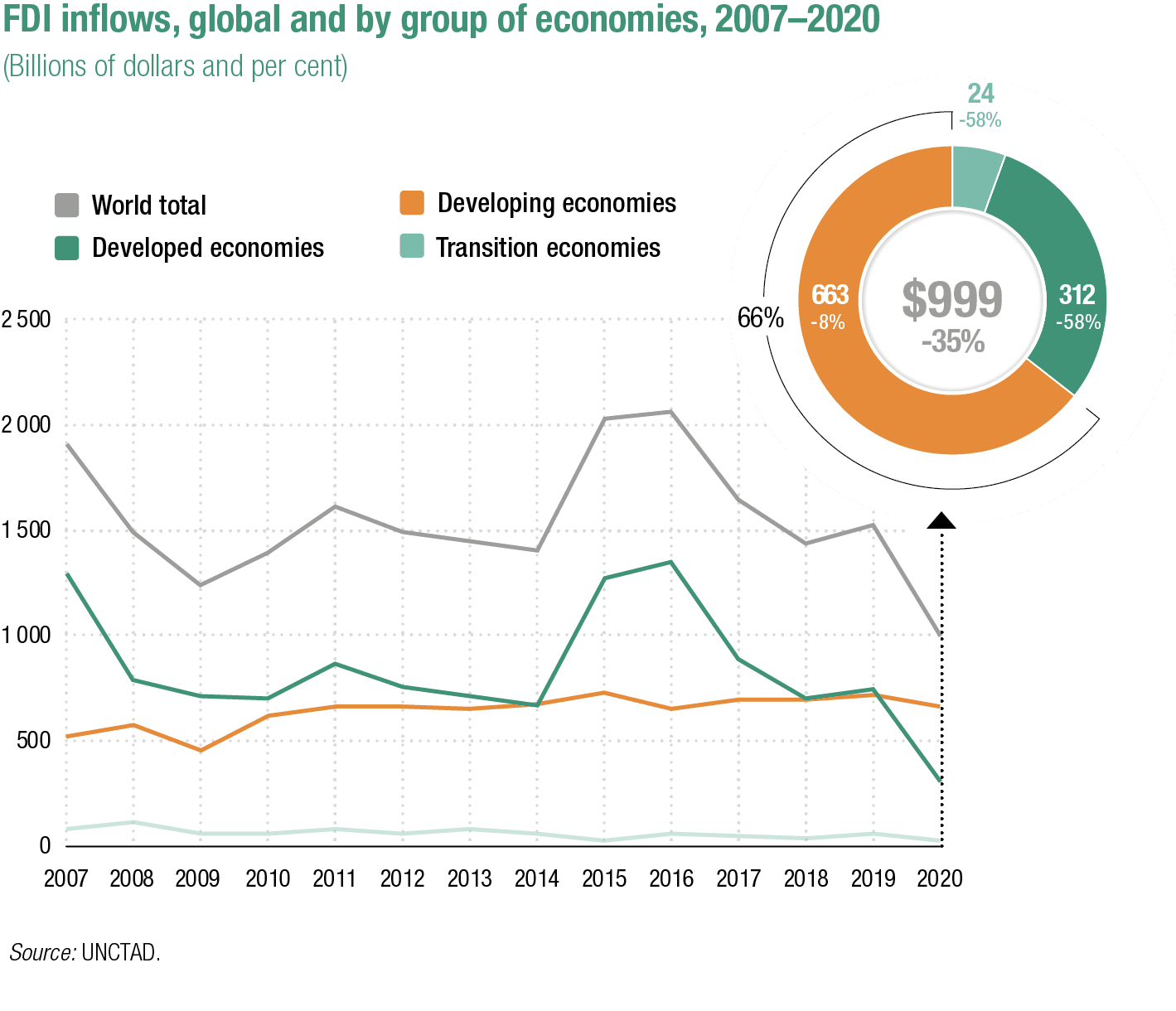

Global FDI inflows chart

The trio of crises—food, fuel, and finance—will be considered as indirect impacts on FDI inflows. Countries come and go from two conflicting countries, Russia and Ukraine, when they suspend some projects or, worse, cancel some announced projects. In addition, when interest rates in the United States are at the same rate. Mergers and acquisitions projects may slow as the number of major economies grows, slowing financial project growth.

Read more: Prospects for the Best Emerging Countries to Invest in 2023

Global investment trends are mainly focused on sustainable development projects, so what are the top 20 best countries to invest in? Not only in terms of industry groups, but among the options to choose the top 10 countries worth investing in, or even the top 20 countries, the majority of countries will come from developing economies. Because while Europe is facing an energy crisis, inflation risks are increasing in the US, developing countries, especially in Asia, have launched stimulus packages to attract foreign direct investment.

If we consider the 20 best countries to invest in via FDI inflows in the two pandemic years of 2020 and 2021, there are six Asian countries participating. In particular, China, Hong Kong, and Singapore have held the first three positions in the ranking of the top 20 FDI growth countries, while European countries maintain the middle and bottom positions of the ranking.

When FDI inflows into Asia reach a record level, what is the reality of investment in Vietnam? Which industries are trending and are likely to get more attention in 2023?

According to the latest report of the General Statistics Office, by January 2023, the total registered FDI capital in the Vietnam market only reached US$1.69 billion, down about 19.8% compared to the same period in 2022. 2022 can be considered. was a slow year for the real estate market when there were continuous negative events from large real estate corporations.

However, according to a report by the Ministry of Construction, FDI inflows into the real estate sector in 2022 increased by 70% compared to 2021, reaching US$1.85 billion.

– Samsung:

Samsung stands as one of Vietnam’s most triumphant foreign investors. With a commitment exceeding $20 billion in investments, the conglomerate has been instrumental in generating more than 200,000 employment opportunities. Within the confines of its Vietnamese factories, Samsung spearheads the production of an array of electronic marvels, including smartphones, televisions, and an assortment of cutting-edge devices.

– LG:

In a similar vein, LG has emerged as another remarkable foreign investor in Vietnam’s thriving landscape. Having infused over $5 billion into the nation, LG has contributed significantly by creating over 30,000 job opportunities. LG’s manufacturing facilities in Vietnam specialize in the production of televisions, refrigerators, and various household appliances, shaping the local market.

– Intel:

Intel, a global semiconductor giant, has established its presence as one of the foremost foreign investors in Vietnam’s semiconductor sector. The corporation’s unwavering commitment, exceeding $1 billion, has led to the creation of more than 3,000 job opportunities. Intel’s state-of-the-art factory in Vietnam plays a pivotal role in crafting cutting-edge chips for computers and a diverse range of electronic devices.

In 2023, the real estate industry in general and industrial real estate in particular are expected to grow again. More specifically, new industrial real estate inventory has been added. According to the Department of Housing and Real Estate Market Management, the demand for industrial real estate rental in late 2022 is still high, and rental prices will even increase slightly by about 5% compared to the first two quarters of 2022.

It is not easy for Vietnam to be ranked among the top 20 best countries for investment, but looking at data on FDI inflows to Vietnam, particularly in the real estate industry, is a good sign, demonstrating the Vietnam’s emerging from developing countries in 2023 despite the global economic situation.

Read more: Foreign Direct Investment in Vietnam: An Overview