Last year, the Taiwanese Chamber of Commerce in Hanoi celebrated its 30th anniversary, and in 2024, the chambers in Ho Chi Minh City and Dong Nai Province will also mark three decades. These milestones highlight Taiwan’s longstanding investments in Viet Nam and strong business ties between the two economies.

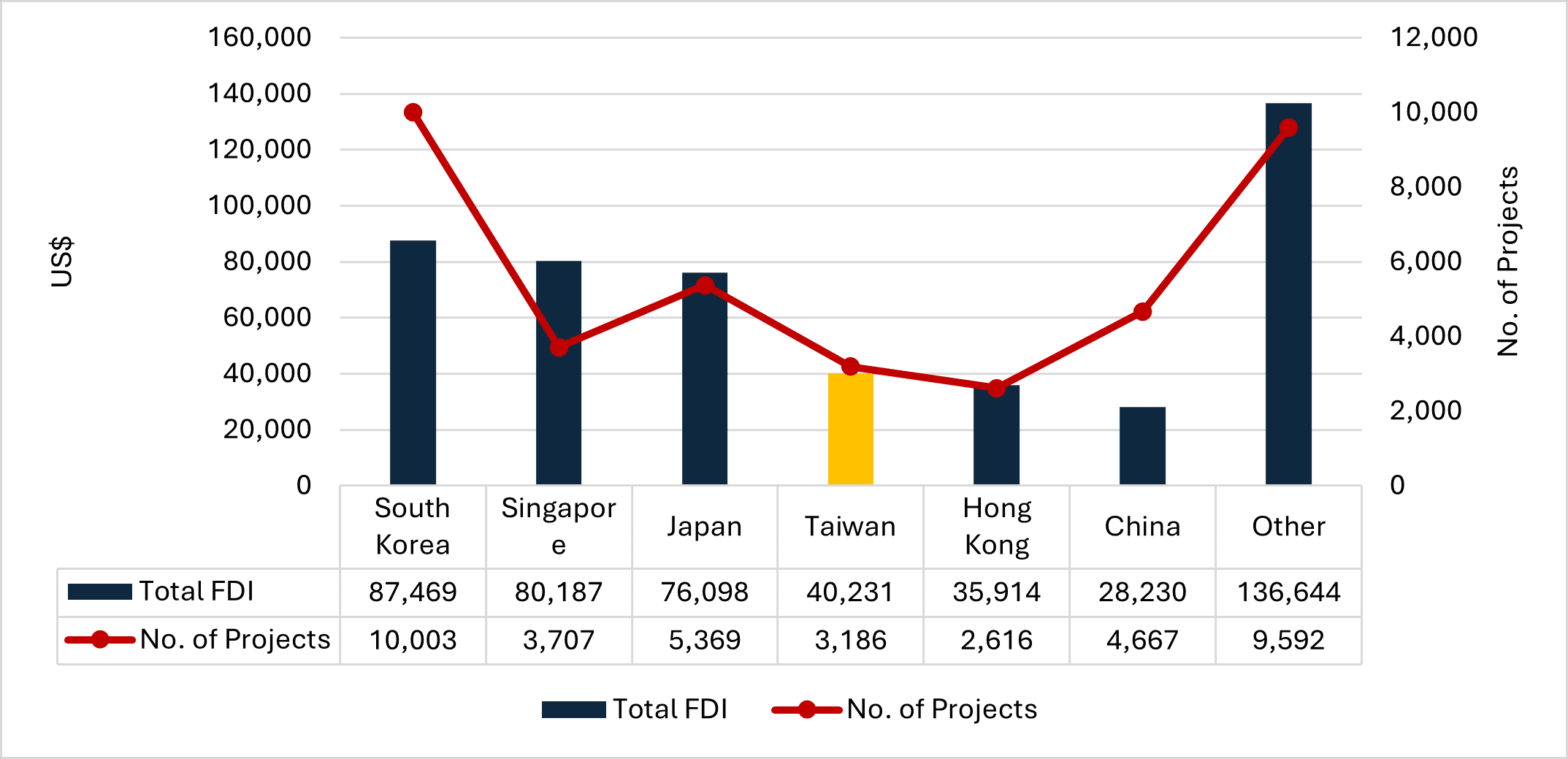

In the first 20 years after Viet Nam engaged in its doi moi economic reforms, Taiwan was the largest source of foreign investment to Viet Nam, creating many jobs and contributing to the country’s socioeconomic development journey. By 6M/2023, Taiwan placed as the fourth largest investment source with 3,186 projects and US$40.23 billion, representing 8% of total FDI in Viet Nam since 1988.

Figure 1: 1988 – 6M/2024 Taiwanese FDI

Source: Ministry of Planning & Investment (MPI), Savills Viet Nam, 2024

Taiwan’s FDI in Viet Nam continues its steady rise. A survey by Taiwan’s Ministry of Economic Affairs shows that around 18% of Taiwan’s traditional manufacturing enterprises have expressed interest in investing in Viet Nam, highlighting its attractiveness.

The rise in investment is in line with Taiwan’s New Southbound Policy (NSP), enhancing cooperation with Southeast Asian nations. Since its inception in 2016, the NSP has markedly increased cooperation with Southeast Asia, significantly benefiting Viet Nam’s high-tech electronics sector.

Taiwanese investors favor Viet Nam’s young and increasingly skilled workforce, stable business environment, competitive labor and construction costs, geographical location near source and destination markets, and its active participation in a multitude of free trade agreements (FTA).

In recent times, a growing number of Taiwanese manufacturers have established firm footholds in Viet Nam to diversify supply chains and mitigate product risks, among them electronics giants like Foxconn, Pegatron, Compal, and Wistron.

Viet Nam is ambitious to become a semiconductor hub, whilst Taiwan is renowned for its successful semiconductor industry and can therefore offer valuable expertise that Viet Nam can leverage to achieve its objectives. The North of Viet Nam is expected to continue to attract Taiwanese electronics and semiconductor investments, whilst the South is likely to receive mid-value added manufacturing projects.

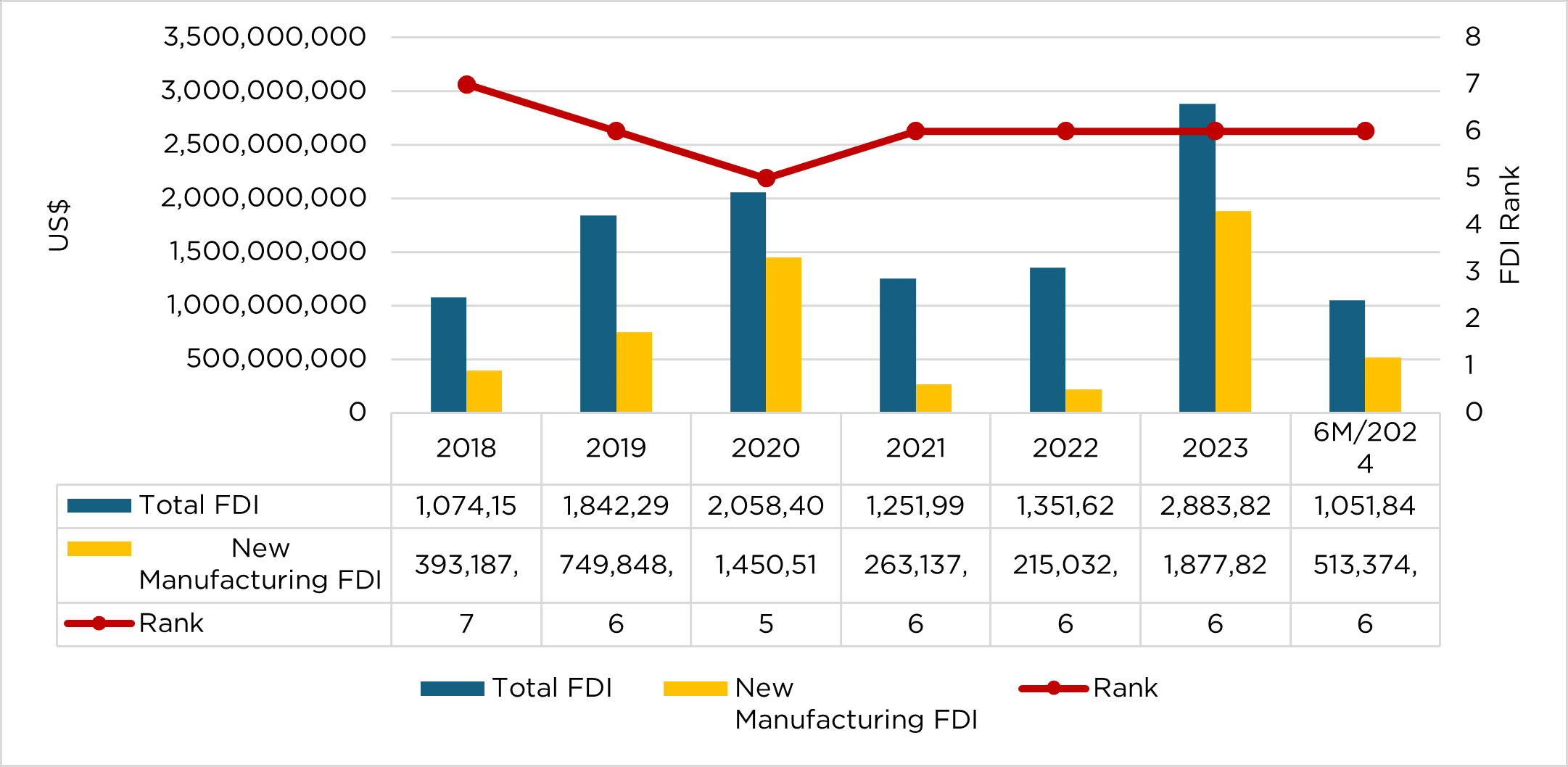

Viet Nam attracted foreign direct investment (FDI) of US$36.6 billion 2023, increasing over four-fold from 2022. Taiwan was the sixth largest contributor with US$2.88 billion, representing 8% of total registered FDI and up 13% from 2022. This performance reinforced the strong economic ties and long-standing relationship between the two regions. Electronics remain the largest manufacturing industry from Taiwan in 2023.

In 6M/2024, Viet Nam attracted registered FDI totaling US$15.18 billion, up 13% year-on-year (YoY). Manufacturing accounted for 70% registering US$10.68 billion, up a significant 26% YoY. Of which, there were 541 new manufacturing projects registering US$6.82 billion, 390 existing manufacturing projects increasing capital, and 190 projects with capital contributions and share purchases.

In terms of total registered FDI, Taiwan was the sixth largest contributor with US$1.05 billion or 7% of the total, with 88 new projects registering US$529.8 million, 46 existing projects increasing capital of US$392.9 million, and 93 projects with capital contributions and share purchasing amounting to US$129 million.

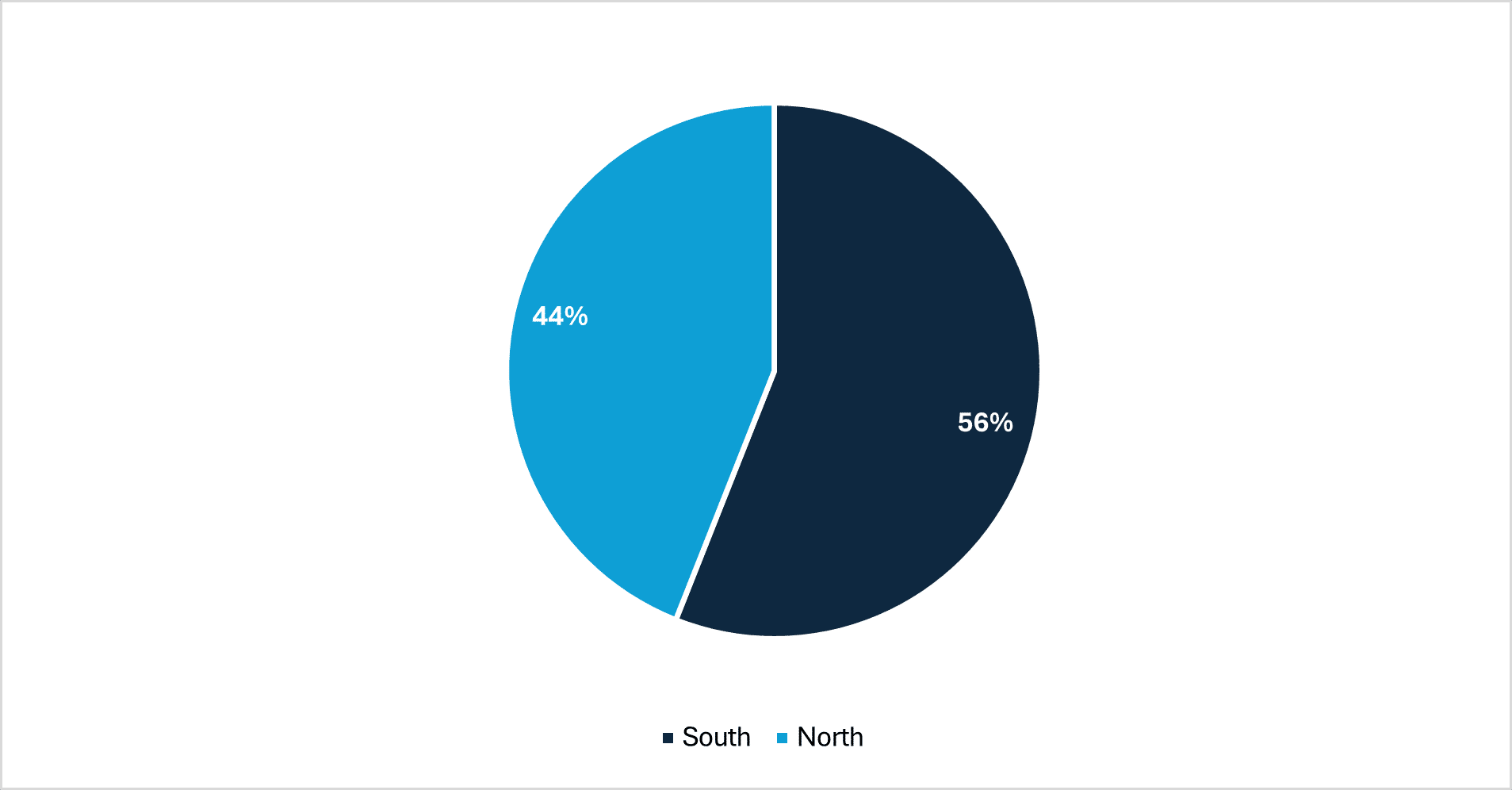

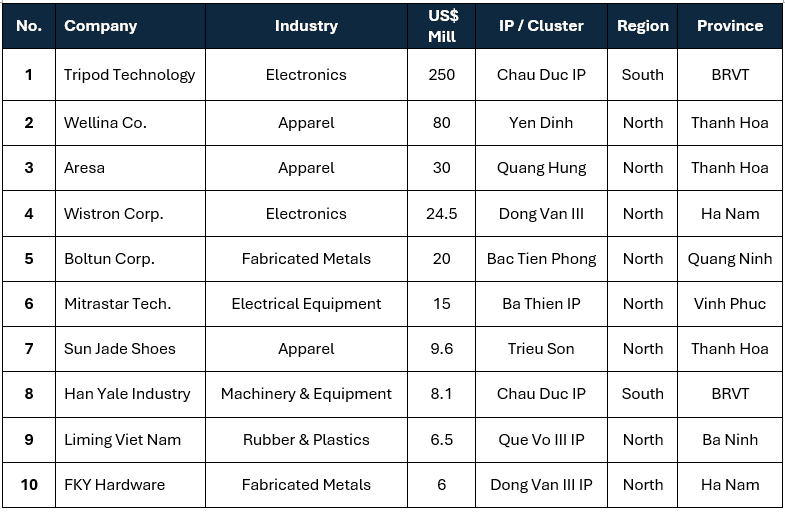

Taiwan had 39 new manufacturing projects registering US$513.37 million in the first six months of the year, representing 49% of Taiwan’s total FDI during the period. Of which 22 projects were in the Northern Viet Nam and 17 were in Southern Viet Nam. Although the North had more new Taiwanese manufacturing projects, the South received the bigger portion with US$285.4 million or 56% mostly due to a significant investment of US$250 million by Tripod Technology in Chau Duc IP in Ba Ria-Vung Tau Province.

Figure 2: Newly Registered Taiwanese Manufacturing by Region, 6M/2024

Source: Savills Viet Nam, 2024

Table 1: Largest Taiwanese Manufacturing Projects, 6M/2024

Source: Ministry of Planning & Investment (MPI), Savills Viet Nam, 2024

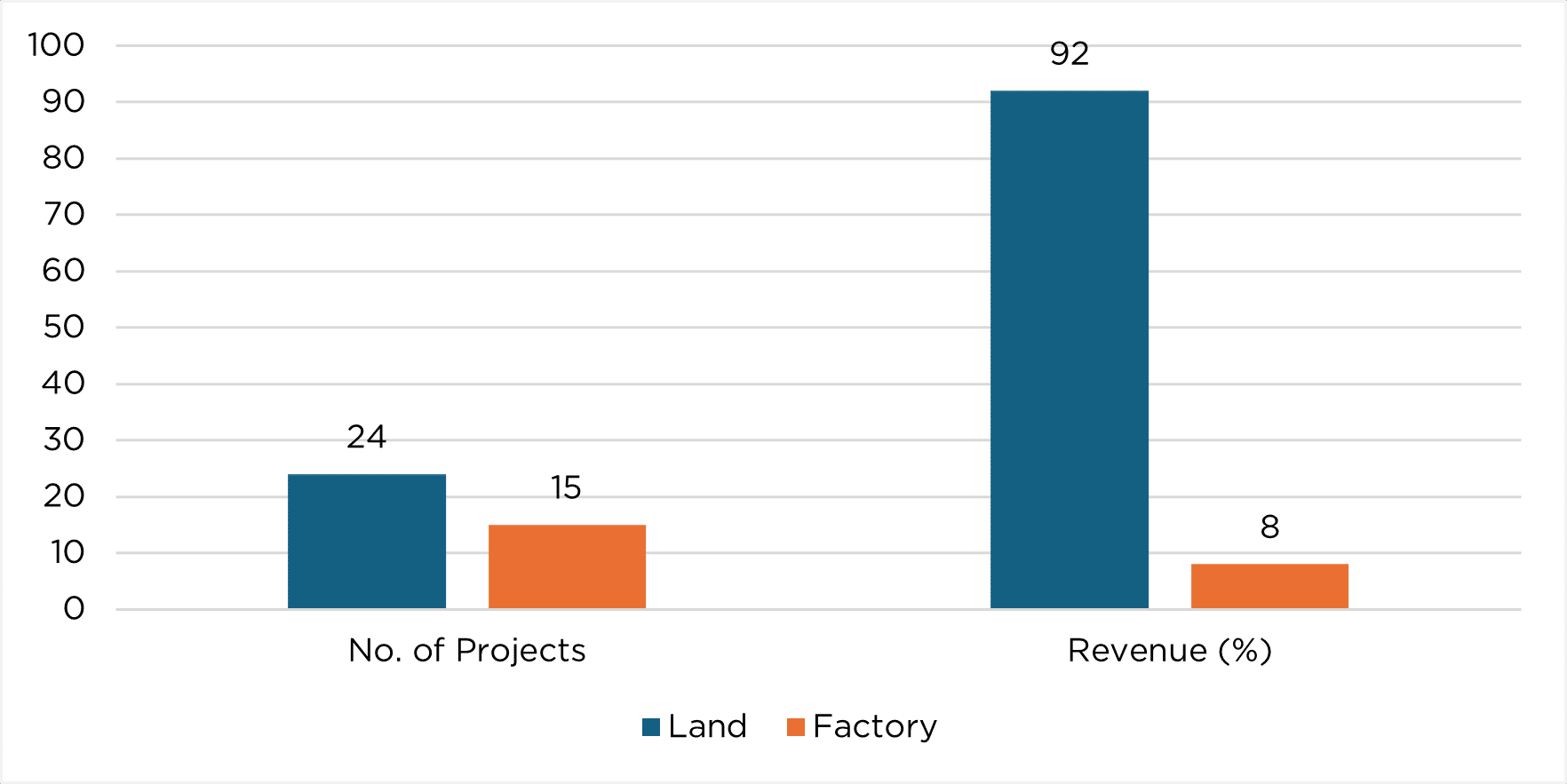

“Of the 39 new Taiwanese manufacturing projects in 6M/2024, 24 were land deals and 15 were factory deals. Land deals dominated in revenue, accounting for 92% of investment capital. However, factory deals, comprising 38% of the total number of projects, indicate growing demand from a variety of Taiwanese manufacturers, from suppliers to large electronic conglomerates to mid value-added industries and SMEs. These companies typically don’t require large land bank and prefer shorter lease terms due to reliance on customer contracts. This demand provides opportunities for Viet Nam’s factory and warehouse developers. For example, BW Industrial Development JSC, the largest industrial rental developer in Viet Nam, now hosts an impressive 18 Taiwanese tenants, including Jusda, Sable Speaker Solutions, FSP Group, and Alltop.”

John Campbell, Head of Industrial Services, Savills Viet Nam

Figure 3: Newly Taiwanese Manufacturing Projects by Property Type, 6M/2024

Source: Savills Viet Nam, 2024

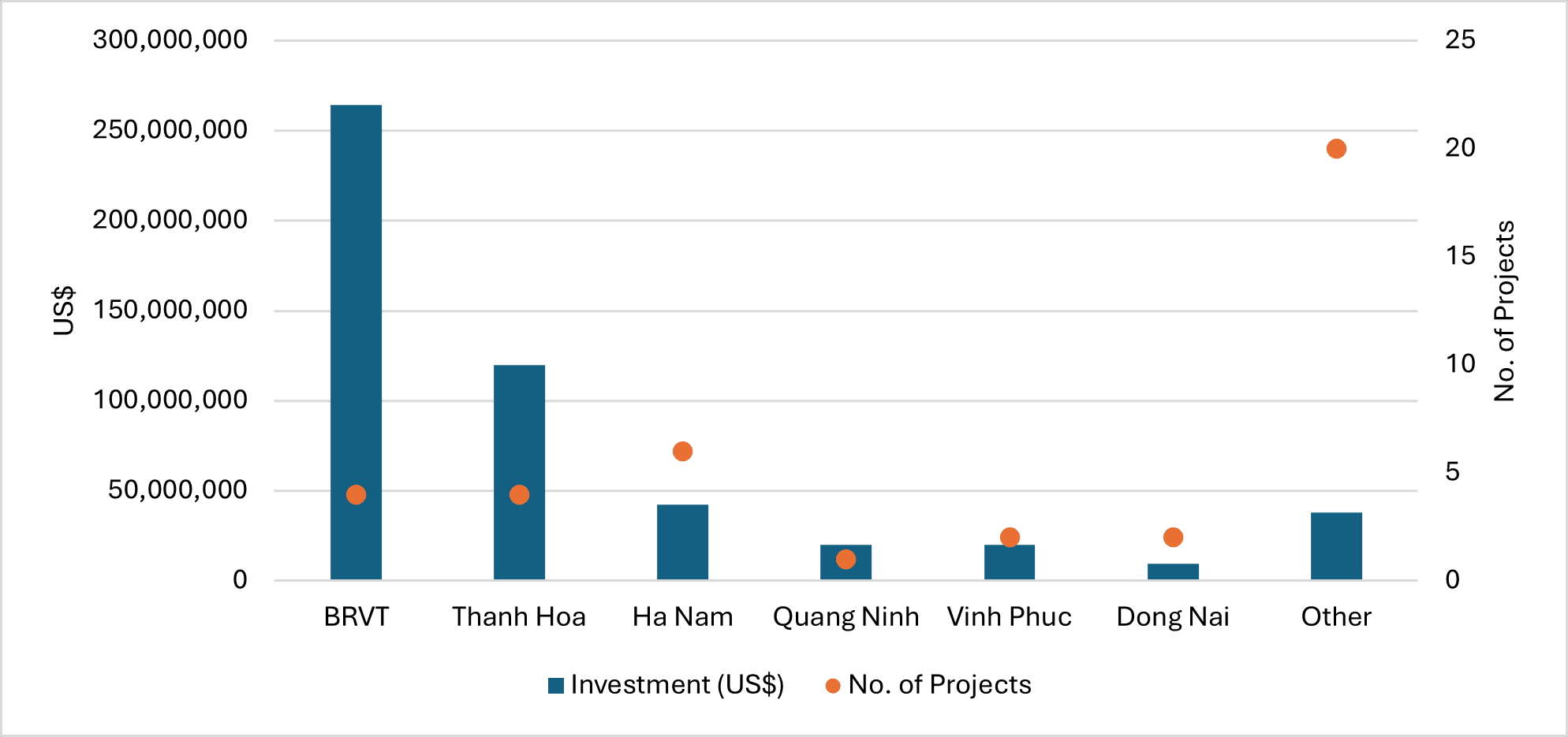

“By province, interestingly BRVT had the lion’s share with US$264.1 million or 51% thanks to Tripod Technology Corporation. While a heavy majority of Taiwanese electronic investments move to the Northern Region, Tripod’s investment in Sonadezi Chau Duc Industrial Park demonstrates the potential of its Southern counterpart. “

John Campbell, Head of Industrial Services, Savills Viet Nam

Thanh Hoa followed in second place with 23% and Ha Nam held third place with 8% but had the highest number projects with six (06) new Taiwanese manufacturing investments. Aside from BRVT, the rest of the top five manufacturing investments were in the North. However, Dong Nai had notable success in sixth place receiving a US$9.6 million investment including a project from TD Hitech Energy Inc.

Figure 4: Newly Registered Taiwanese Manufacturing by Province, 6M/2024

Source: Ministry of Planning & Investment (MPI), Savills Viet Nam, 2024

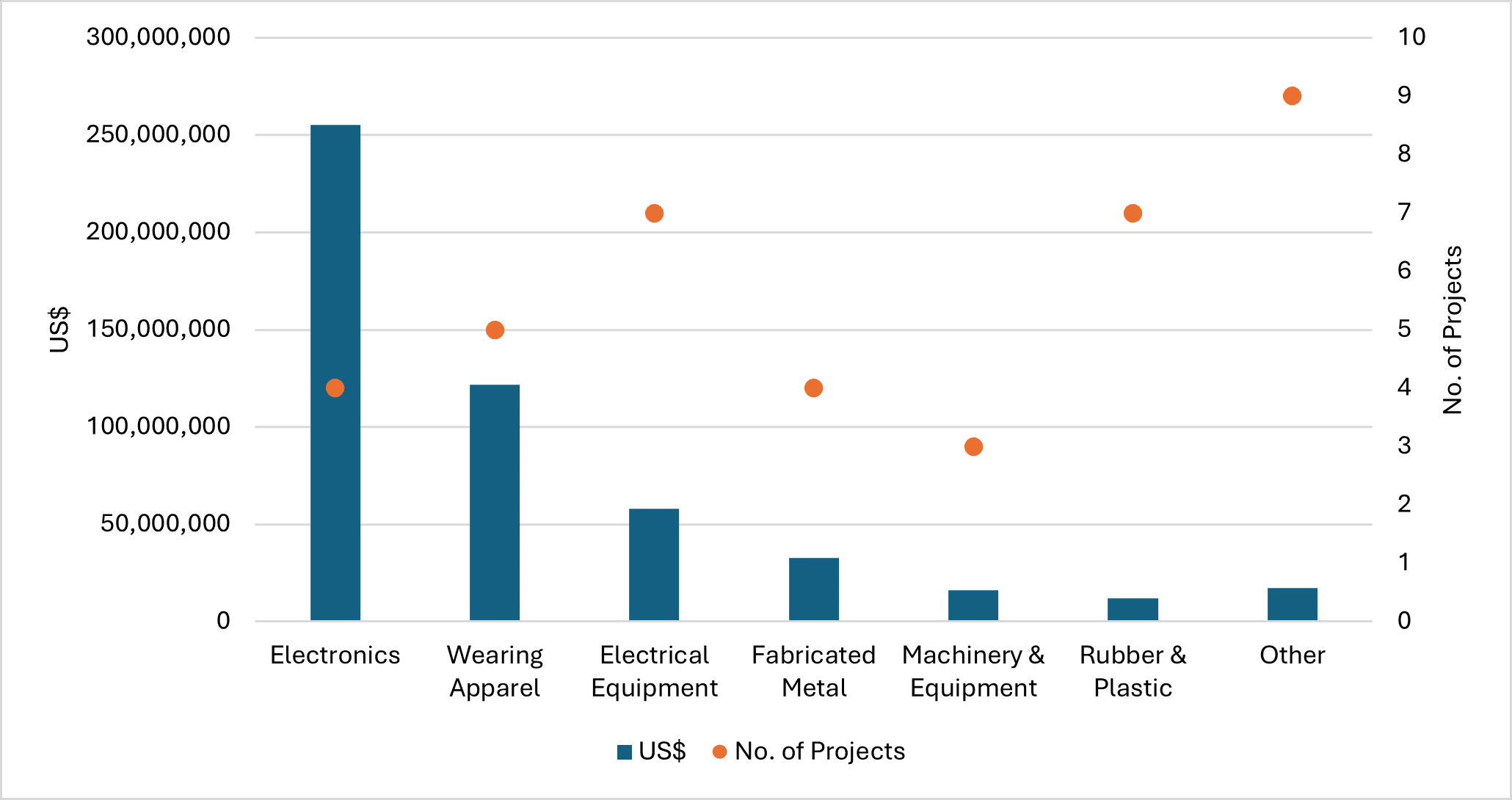

By industry, electronics was in first place with four (04) projects totaling US$255 million or 50%. Wearing apparel was in second place accounting for 24% with five (05) projects, followed by electrical equipment with 11% and seven (07) projects.

Wistron Corporation followed Tripod Technology as the second largest Taiwanese electronics manufacturing investment in 6M/2024 with US$24.5 million,

Figure 5: Newly Registered Taiwanese Manufacturing by Industry, 6M/2024

Source: Ministry of Planning & Investment (MPI), Savills Viet Nam, 2024

Figure 6: Taiwanese Manufacturing FDI, 2018 – 6M/2024

Source: Ministry of Planning & Investment (MPI), Savills Viet Nam, 2024

“When examining Taiwan’s manufacturing FDI in recent years, the most notable trend is the monumental increase from 2022 to 2023, emphasizing the seriousness of Taiwanese investors in diversifying their supply chains to Southeast-Asia after the pandemic. For context, Taiwan’s newly registered manufacturing FDI in 2023 was US$1.87 billion, which is almost a staggering 8.7 times that of 2022. In 6M/2024, Viet Nam has already attracted over US$513 million in new Taiwanese manufacturing investments, with expectations of further substantial increases by year-end when more major electronics projects complete their registrations.”

John Campbell, Head of Industrial Services, Savills Viet Nam