Macroeconomic trends show that best emerging countries to invest in are one of the ideal places for foreign investment. However, in light of recent events that have had a significant influence on the global economy, investing in the best developing countries remains the preferred option, and if a move to less developed countries is required, it is still vital to invest in the finest emerging countries. What are the typical risks to consider? And finally, which are the best emerging countries to invest in? Read more to find out.

We often hear and read articles related to the best emerging countries to invest in, but more specifically, they’re referring to their economic potential. Many investors think that investment opportunities in countries can be very promising, but in fact, economic potential is a term that not everyone understands exactly what it means or what it includes. how to create that potential.

To put it simply, “economic potential” is a term that refers to the ability of a region or a country to support economic growth and development. Usually, these potentials are untapped. In economic potential, it mainly refers to factors such as human, financial, and material resources, sometimes including military economies, to ensure political stability so that the country can stabilize its development.

How the Economic Potential is Measured

Investing in Asian developed countries requires huge amounts of capital, which is part of the reason that when investors consider potential countries to invest in, they often look to opportunities in developing countries. develop. Developing countries, often called “emerging economies,” often have fast economic growth and high rates of return.

However, investors must know that with high returns come greater risks, including some typical risks such as economic instability, exchange rate risk, etc. So in addition to direct investment, many investors now have other approaches to investing in developing countries, whether through indirect investment funds or considering investment opportunities in less developed countries.

Read more: Golden opportunity for Best Asian Countries to Invest in 2023

Whether investing in developed, developing, or underdeveloped countries, there are certain risks. When considering opportunities in countries with potential for investment, some investors will consider even less developed countries. This can indeed be considered a bold consideration because it can be clearly seen that the typical risk when investing in LDCs is much higher than in the other two groups but that the return rate is low. much more than developed and developing countries.

The first risk to consider is a political one. Usually, the political system in less developed countries is considered weak, and the legal regulations are not yet strict. Although a few less developed countries have undergone structural and production capacity transformations, the COVID-19 pandemic has shown us more clearly about the resources and economic potential of these countries. The growth rate of the least developed countries has fallen to its lowest level in the last 30 years. (Comments from the Report of the United Nations Conference on Trade and Development)

Emerging markets in Asia

Each investor will have their own view of investment opportunities in developed, developing, and underdeveloped countries. If you have followed the market for a long time, surely investors are no strangers to the fact that each year there will be different investment trends and industries. Even when assessing countries with the potential to attract a lot of people, it will also consider whether the country has any advantages in the new investment trend. Or for each industry, investors can rank the top countries in that sector to review investment opportunities.

Let’s delve deeper into five countries that investors are aiming for:

– and their prowess in different industries.

Vietnam is rapidly positioning itself as a prominent player in the technology and innovation sector. With a young and tech-savvy population, the country is witnessing an upsurge in software development, AI, and e-commerce startups. Its strategic location in Southeast Asia enhances its appeal as a manufacturing and logistics hub. Investors are drawn to Vietnam’s low labor costs, improving infrastructure, and robust government support for technology-focused ventures.

According to a report by StartupBlink, Vietnam is home to over 10,000 active startups. The country’s technology sector is growing at a rapid pace, with a compound annual growth rate (CAGR) of 25% between 2017 and 2022.

Among the highlights, Vietnam is also a major manufacturing hub in Southeast Asia. The country’s labor costs are among the lowest in the region, and its infrastructure is improving rapidly. The Fourth Industrial Revolution may boost Vietnam’s GDP by $28.5 billion to $62 billion over a decade, depending on the extent of technology application in firms. This growth is comparable to a 7-16% increase in GDP by 2030.

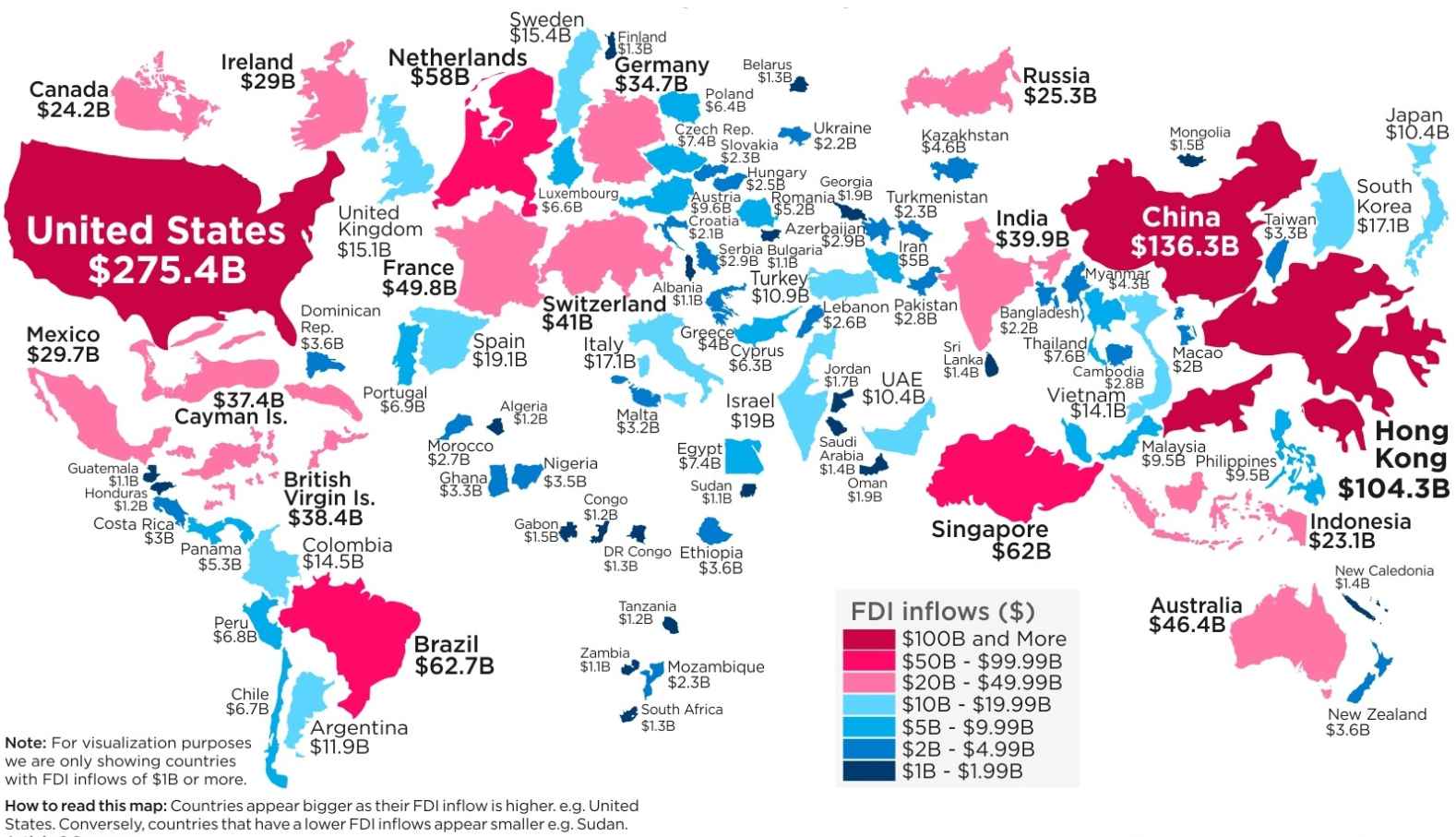

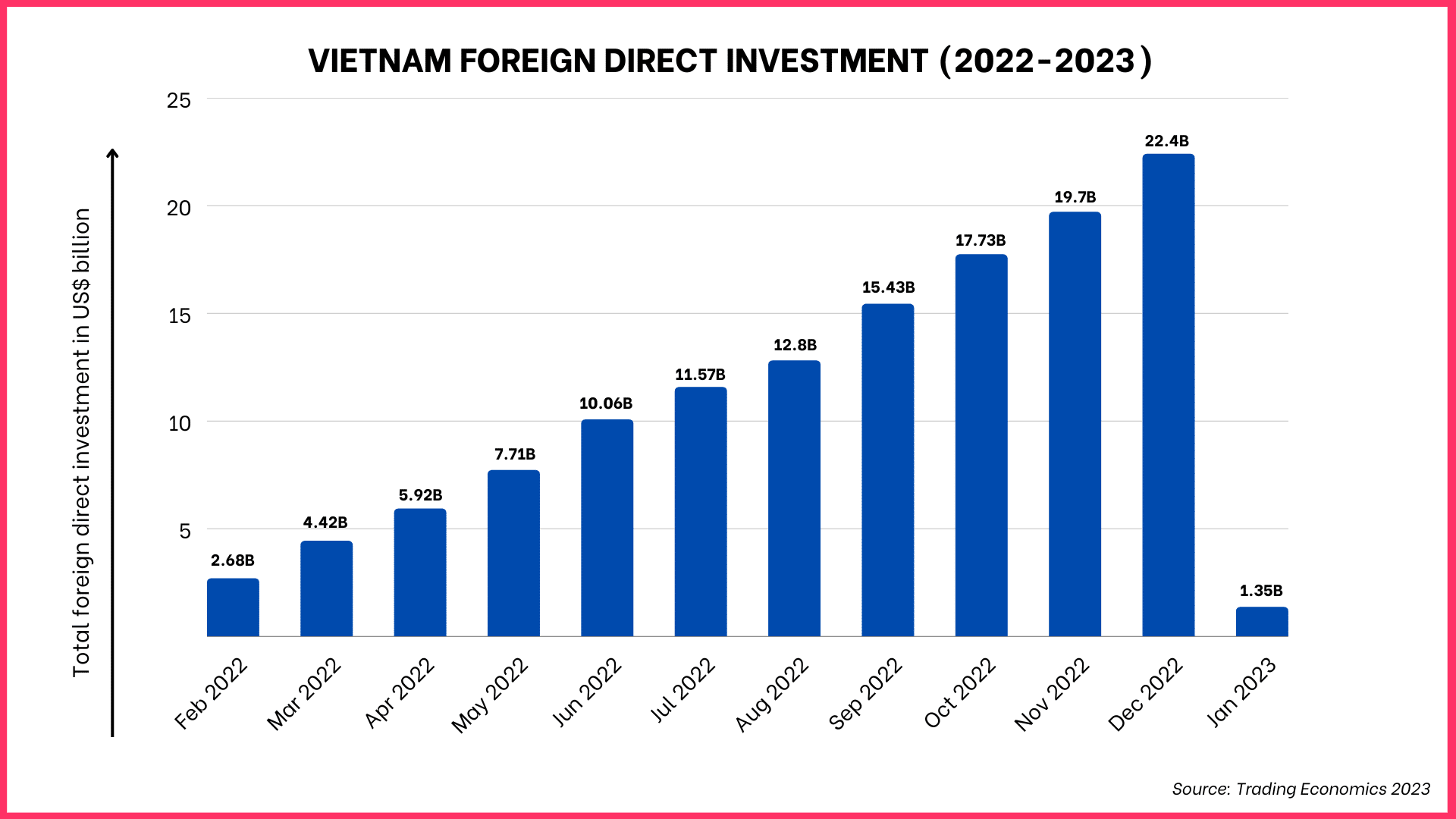

Vietnam’s government has proactively taken steps to enhance its attractiveness to investors and foster an improved business environment. Notable measures include the simplification of bureaucratic processes, streamlining registration procedures, and providing lucrative tax incentives. A pivotal driver of the surge in Foreign Direct Investment (FDI) in Vietnam is the “China +1 strategy.” This strategic approach has gained traction as companies seek alternatives to counter the escalating labor costs in China, thereby safeguarding their competitiveness. Vietnam has emerged as a prime choice due to its favorable labor costs and its geographical proximity to China, facilitating the seamless reconfiguration of supply chains.

Moreover, Vietnam’s strategic free trade agreements, including the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), have significantly bolstered its investment appeal. The EVFTA, inked in 2019, maps out a trajectory of virtually tariff-free trade between the EU and Vietnam over the ensuing decade. Likewise, the CPTPP has dismantled trade barriers between Vietnam and fellow members such as Canada, Australia, and Japan. This confluence of factors has solidified Vietnam’s standing as an increasingly sought-after destination for global investors seeking to harness its advantages and augment their market reach.

As Vietnam’s economy continues its robust growth trajectory, the tide of investors gravitating toward this nation is anticipated to swell. The prevailing economic conditions and the amalgamation of favorable policies and agreements establish Vietnam as a fertile ground for fresh growth prospects. The country’s trajectory as a burgeoning hub for international investment appears poised for sustained expansion.

Brazil remains a force to be reckoned with in the agribusiness sector. Its vast arable land and agricultural expertise make it a major player in global food production. Additionally, Brazil’s commitment to sustainable practices positions it as a leader in renewable energy.

The country’s substantial wind and solar resources, coupled with its potential for biofuels, attract investors seeking to contribute to a greener future. The Brazilian government is providing strong support for the development of renewable energy. In 2021, the government announced a $10 billion investment in renewable energy projects.

Indonesia’s burgeoning middle class and rapidly growing internet penetration have transformed it into a prime destination for e-commerce and digital service investments. TIndonesia is home to a thriving tech startup ecosystem.

The country has produced several unicorns, including Gojek and Tokopedia. Investors are capitalizing on Indonesia’s immense consumer market and the increasing popularity of online retail. In 2022, Indonesia’s tech startup ecosystem attracted over $5 billion in funding.

Sitting at the crossroads of Europe and Asia, Turkey boasts a strategic geographic location that positions it as a crucial trade and investment hub. The country’s young population and expanding middle class contribute to its attractiveness in sectors like manufacturing, tourism, and real estate. Despite challenges, Turkey’s efforts to modernize its economy and infrastructure remain appealing to investors seeking long-term growth prospects.

South Africa’s rich mineral resources, coupled with its thriving tourism industry, offer investment opportunities in diverse sectors. The country is a major global producer of precious metals, and its mineral wealth extends beyond mining to value-added processing. Additionally, South Africa’s well-established financial services sector and robust regulatory framework draw investors looking for stability in uncertain markets.

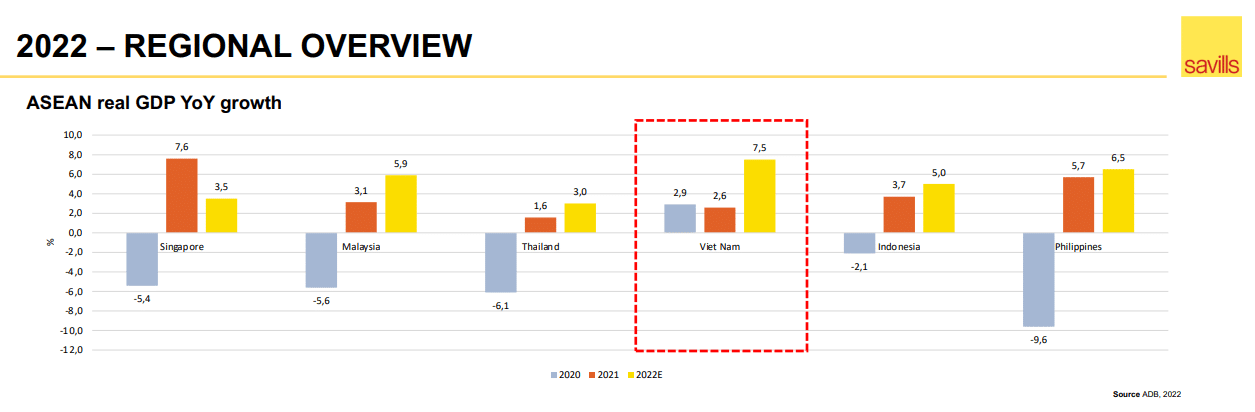

Economies around the world also have policies to gradually adapt and become ideal for investment post COVID-19 pandemic, and Vietnam is no exception. If the pandemic gives us a better view of the risks of investing in less developed countries, it will also be a “test” for policies and the Vietnamese economy. Of all the countries with potential for investment, especially in Asia or Southeast Asia, Vietnam is always an indispensable name.

According to experts from international banks such as Landesbank Baden-Württemberg, with political stability, an adjusted monetary policy, loosening policies to attract investment capital, and an abundant workforce, Vietnam would The South is still one of the potential destinations for foreign businesses.

Want to know more about Vietnam’s market and industrial potential in 2023? Contact Savills Industrial today!

Read more: Is Vietnam One of The Top 20 Best Countries to Invest In?