After a challenging 2023, Viet Nam’s industrial sector has regained momentum, propelled by high-value investments in electronics, semiconductors, solar, and electric vehicles (EVs). Industrial Insider 2024: New Wave reveals how these sectors are positioning Viet Nam as a strategic player in global manufacturing, highlighting the forces advancing the country up the value chain.

This whitepaper offers essential insights for occupiers, investors, developers, and industry leaders looking to leverage Viet Nam’s expanding industrial landscape.

Viet Nam’s industrial success is underpinned by its dynamic workforce, supportive government incentives, trade openness, strategic location, and continuous infrastructure improvements. High-value sectors like electronics and semiconductors are driving this growth, shaping real estate demand, and attracting regional investment.

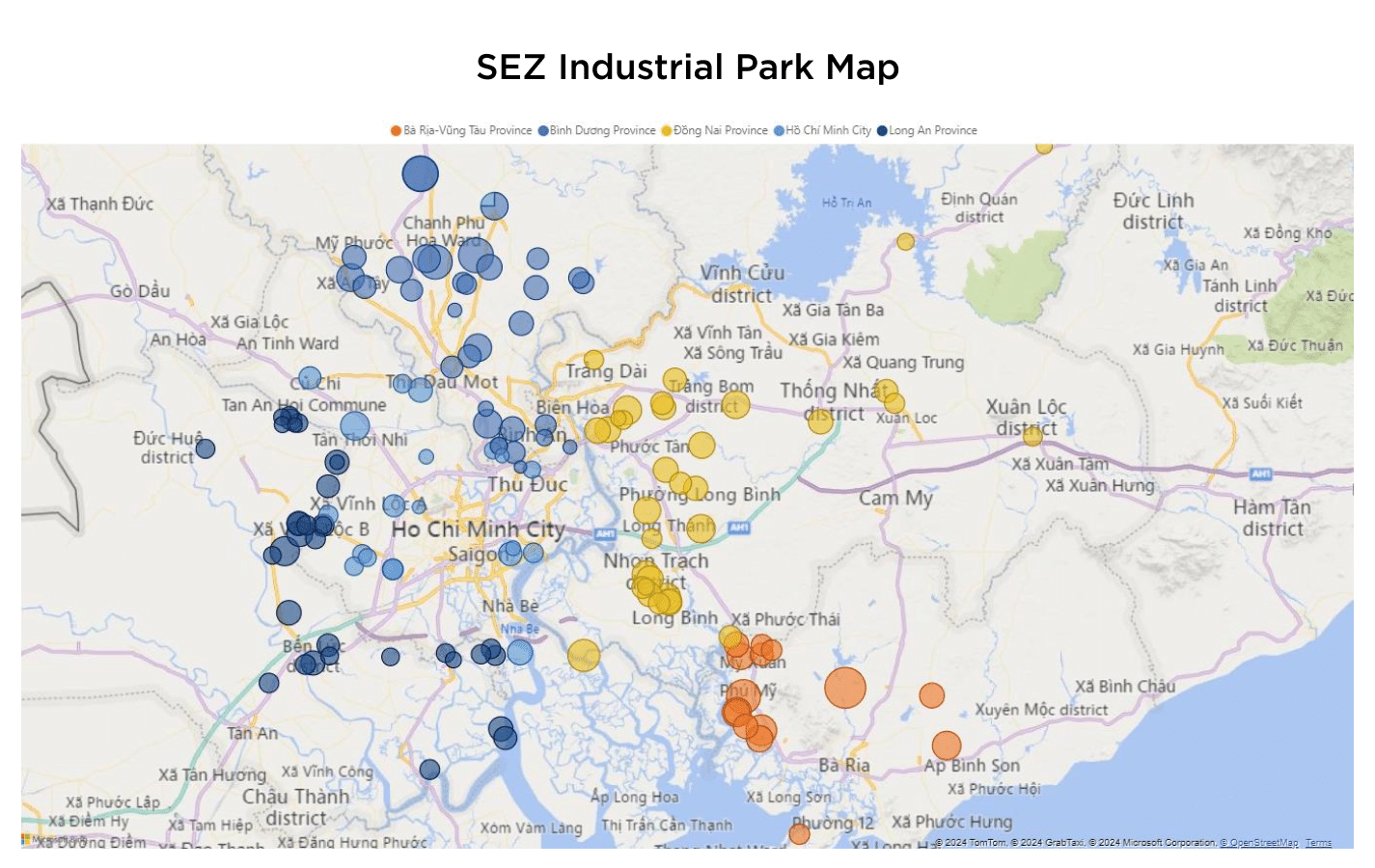

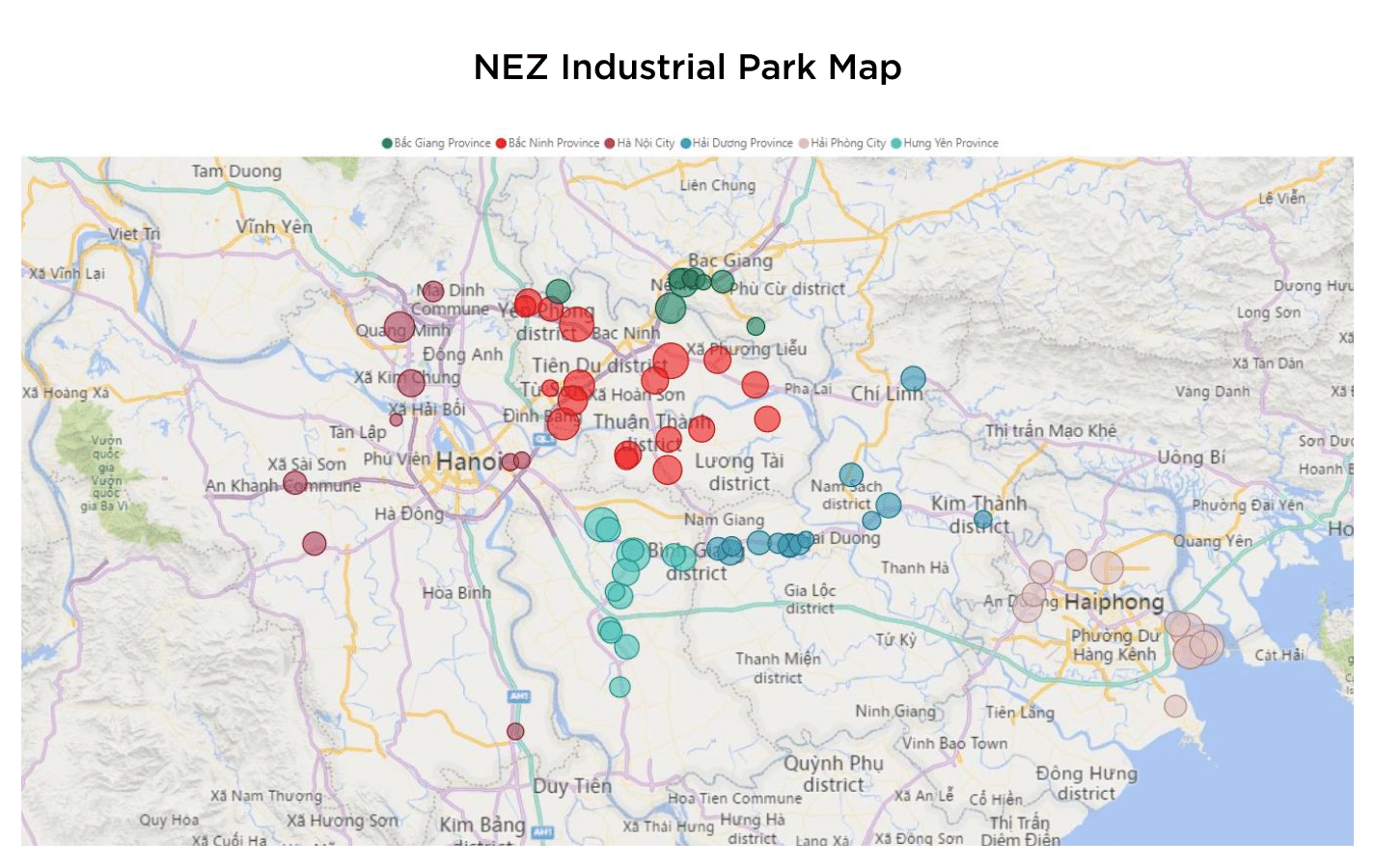

Readers will find a comprehensive analysis of key industrial regions set for expansion, alongside infrastructure projects supporting long-term growth.

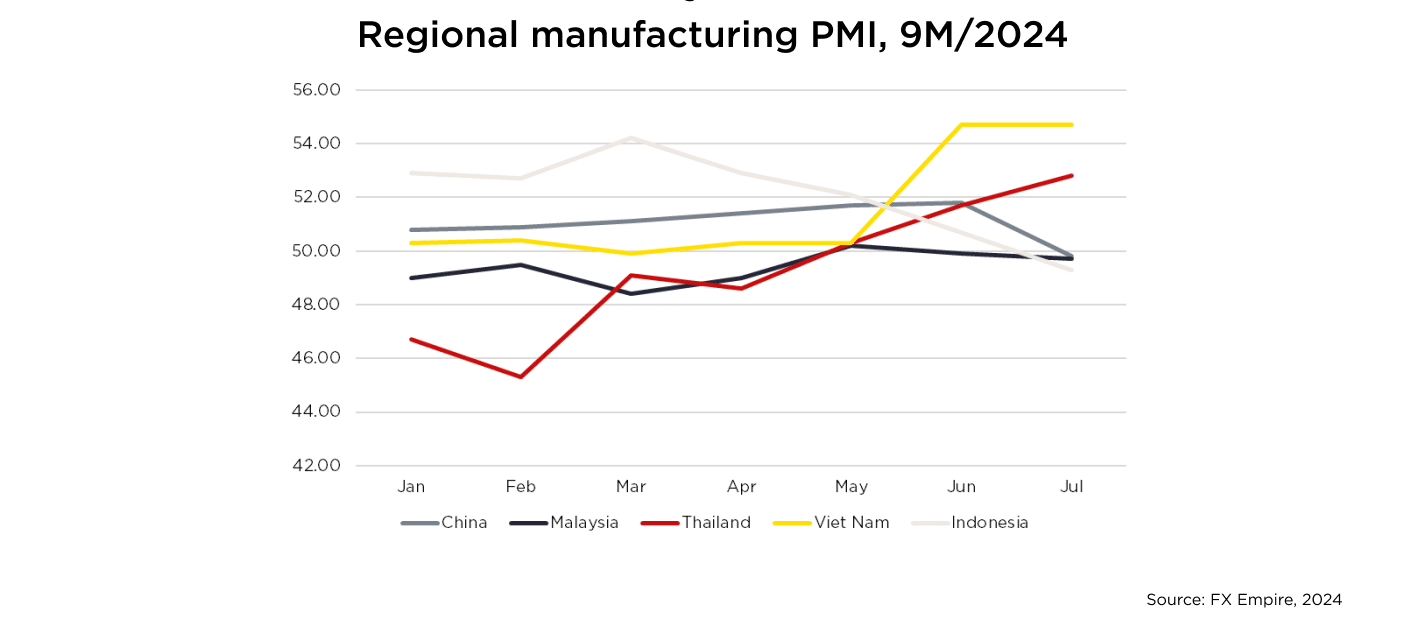

Regional Manufacturing PMI (9M/2024)

“Viet Nam has changed from traditional dirt-floor manufacturing, with companies just seeking a lower cost of labour, to a country that is high-tech, more intensive, with tertiary manufacturing.”

Troy Griffiths, Deputy Director, Savills Viet Nam

“Viet Nam’s robust exports of manufactured goods have played a crucial role in its economic rebound this year. Resurging inflows of FDI into value-added production industries have significantly boosted the country’s overall export growth, with electronics standing out as the major contributor.”

John Campbell, Head of Industrial Services, Savills Viet Nam

With a strategic location, large workforce, and expanding infrastructure, Viet Nam is primed for continued industrial growth. Key investment policies, a robust pipeline of infrastructure projects, and the ongoing shift in global manufacturing (China +1) are expected to drive high-value industries and FDI in 2025.

The country’s commitment to public investment and broad network of trade agreements will further reinforce its competitive edge, positioning Viet Nam as a focal point in the regional supply chain.

For detailed insights and key takeaways, download Industrial Insider 2024: New Wave. See how Viet Nam’s industrial sector is gearing up for the future and how you can leverage the next phase of growth.